Look For Weakness In The Beige Book and Selling Pressure Into Next Week!

This week, the market is taking a breather after a big run-up. The strongest companies report early and we typically see a rally as earnings season kicks off. During the last three quarters, stocks have retreated after the first few weeks of releases.

Bulls have been able to push stocks higher uncontested. Concerns over a European credit crisis have eased and the economic calendar has been light. The Eurodollar has rebounded and some of the PIIGS bond yields have actually pulled back slightly. The bank stress test (although it was a joke) has also calmed nerves. The issues have not been resolved and these concerns are likely to flare up at a moment's notice.

The economic calendar will be loaded during the next seven trading days. This morning, durable goods orders fell 1% and that was worse than expected. This is a very volatile number and traders tend to take it in stride. This afternoon, the Fed will release its Beige Book. I am expecting to see weakness across the country and that should spark selling into the close. Friday, consumer sentiment and GDP will be released. In its FOMC statement, the Fed lowered its 2010 forecast for GDP and we might see signs of weakness during this Q2 estimate.

A year ago, credit markets locked up and businesses could not get money to replenish inventories. That created a huge drawdown and much of this economic recovery can be attributed to a rebuilt in inventories. Two weeks ago, wholesale inventories increased and sales declined. This is already having a negative impact on manufacturing. We have seen that in the Entire Index, ISM manufacturing, the Philly Fed and the Chicago PMI. Next Monday morning, ISM manufacturing will be released and I am expecting a weak number. If it comes in at 53.5 as expected, this would mark the third consecutive decline.

Monday morning, China will release its PMI. Some analysts are expecting it to drop below 50, representing economic contraction. Last month it fell from 53.9 down to 52.1. If the forecast for a weak number holds true, the market will tank. All hopes of an economic recovery are pinned to China.

As next week unfolds, we will get factory orders, the ADP employment index, ISM services, initial claims and the Unemployment Report. Consensus estimates are calling for a loss of 116,000 jobs. There have been many seasonal adjustments to the initial claims number on a week-to-week basis and I really don't have a good read on where the employment number will come out. The key will lie in the private sector and that makes the ADP report very important to watch.

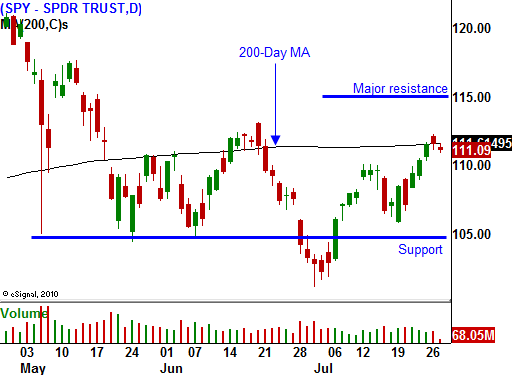

The market is resting just below the 200-day moving average. The longer it sits here, the greater the resistance. Trading activity will decrease in coming weeks and that is typical in August. In a few weeks, the weakest seasonal period for the stock market will be at our doorstep.

Economic conditions will gradually deteriorate and concerns of a double dip recession will surface. The massive deficits in Europe will continue and austerity programs have not addressed the big issues. Think back to the relentless decline in the Eurodollar two months ago. Traders smelled blood and they realize that the entire EU is in jeopardy. Fiscally responsible countries like Germany will not back countries like Spain that have defaulted 13 times in the last 200 years. The banking stress test assumed that there would not be any sovereign defaults. European banks have lent large amounts of money to the PIIGS and the risk exposure is huge.

In a matter of time, the focus will shift to massive deficits in the US. In fact, we will get a taste of that in mid-August when the Fed reviews Fannie Mae and Freddie Mac. It is rumored that collectively these two entities could cost taxpayers $800 billion. States are preparing their budgets for 2011 and early estimates show that they will be in the red by another $84 billion next year. They are already $300 billion in the hole right now. According to the constitution, they cannot run in the red. State and local governments will cut payrolls.

Government stimulus and the inventory cycle have run their course and the next catalyst is nowhere to be found. Emerging markets rely on exports to the Western Hemisphere and we are out of money. They don’t drive our economy, we drive theirs.

I am lining up my bearish plays and I will start scaling into longer term puts today. I will build my positions throughout August. Look for selling this afternoon and into next week.

Daily Bulletin Continues...