I’m Back – One Big Up Day and No Follow Through Last Week.

Last week the market staged a big rally Monday and it flat-lined the rest of the week. A weak Unemployment Report pushed prices lower, but the bulls were able to recover. That intraday reversal spilled over into the action a week ago.

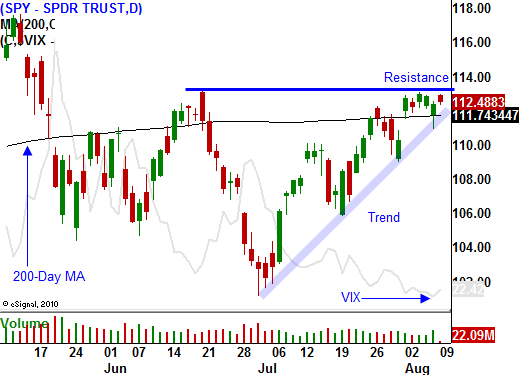

From a technical perspective, the charts look positive. Each time the market declines, buyers step up and a series of higher lows has resulted. In today's chart, you can see the uptrend that has formed. We are now above their 200-day moving average and we are testing horizontal resistance. Periods where the trading volume is light tend to favor the bulls. Funds can bid up the market on very small volume and it can create a false sense of security.

We are heading into the weakest part of the trading year and selling pressure should mount with each passing week. From an economic standpoint, conditions are starting to deteriorate. China's PMI declined to 51.2 and it is on the brink of economic contraction. ISM manufacturing has also rolled over and we have seen three consecutive declines. Initial jobless claims spiked to 479,000 last week and that could signal trouble ahead.

The Unemployment Report was weak and the downward revision to June's number was dramatic. States are slashing payrolls to cut expenses and we can expect to see a continued decline in public sector employment. In a recent research report, it was estimated that local governments allow could shed more than half a million jobs in the next two years. States are preparing their budgets and collectively they project an $84 billion shortfall next year. If not for an uptick in private sector job growth in July, the market would have declined sharply after the report.

Corporations are the key and private sector job growth is the only thing that can keep us out of a double dip recession. Unfortunately, there is too much uncertainty and I don't believe they will aggressively hire. Healthcare reform, the regulatory environment, credit issues in Europe and lackluster consumer sentiment will keep them in a defensive posture. Businesses are lean and mean and they aren't anxious to add overhead expenses.

During last month's FOMC meeting, the Fed lowered its 2010 GDP forecast. Now, traders are speculating that they will reinstate their quantitative easy programs to stimulate the economy. That notion is pushing stocks higher ahead of tomorrow's meeting. I'm not so optimistic. Last year, the Fed threw the kitchen sink at our credit crisis. Once conditions started to stabilize, they gradually withdrew some of their stimulus. They want to have at least one bullet in their gun and I don't believe the conditions are dire enough for them to take a step backwards. If they did renew quantitative easing, the market could start to worry about what is on the horizon.

I don't believe the Fed will take any action or change its rhetoric tomorrow. Quantitative easing did not stimulate consumption or business reinvestment. It did stabilize the credit markets. Consumers are tapped out and they are cautious after a 20-year spending spree. We see that in the consumer confidence numbers and we see that in their spending habits. Colgate and Procter & Gamble said that consumers are "trading down" to less expensive products.

Retailers have been reporting lackluster sales and they have also noticed a trend. Consumers are spending money on necessities, not luxuries. Later this week, we will get retail sales numbers.

As summer winds down, trading volume will decrease - that favors the bulls. The technicals also look decent. A small push could force a breakout and lure bullish speculators in just ahead of a seasonally weak period. By late August, they will have the rug pulled out from under them.

We are seeing a rally ahead of the Fed, and the market could pull back a little on no action. Initial claims and retail sales could weigh on the market later in the week, but each number is likely to be discounted as a “one off” event.

We are in the doldrums and this is a good time to keep your size small. Option premiums have fallen to the low $20’s and we can consider buying options soon. For now, I would sell out of the money puts on commodity stocks (small size). They look strong and we don’t have to worry about China’s PMI until after August expiration. These stocks have good IV’s so you can distance yourself from the action. If we do breakout to the upside, my new entry point for put purchases will be a close below SPY 112. We are above 112 now; I just need to see a small push higher to distance ourselves from that level.

Daily Bulletin Continues...