Buy Longer Term Out of the Money Puts Today – Scale In and Expect to Take A Little Heat!

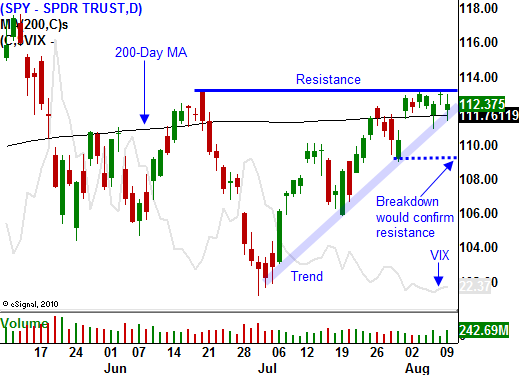

Last week, the market started off with a huge rally Monday and then it flat-lined the rest of the week. Resistance at SPY 113 held and bulls did not have enough firepower to stage a breakout. Given the economic news, I was somewhat surprised by the move.

The prior week, unemployment rose more than expected and June's number was much worse than originally reported. Traders were encouraged by the pickup in private sector employment. Those gains were outpaced by public-sector job losses. States and local governments are laying off workers at an accelerated pace and that will continue.

China's PMI dropped to 51.2 a week ago and it is very close to showing economic contraction. The market discounted that number and it ignored a weaker ISM manufacturing report. It has declined 3 straight months and it has rolled over. Last Thursday, initial jobless claims also spiked to 479,000. The market was resilience and it shouldered what I considered to be negative news.

This morning, bulls are finally throwing in the towel. The overnight news was not devastating enough to justify this morning's 25 point drop in the S&P 500. I believe the market is down because it never deserved to rally to the levels we saw last week.

When trading volumes dry up, even a small institutional bid can move prices higher and generate a false sense of security. We were on the brink of a breakout and bullish speculators jumped the gun. I have seen this often in the last 20 years during the month of August. The so-called "late summer rally" lures traders in and then the rug gets pulled out from under them.

During the last three quarters, earnings season has started off with a bang and then it has faded. Each subsequent decline has been more pronounced. We have heard from the best companies and that impetus is gone. Retailers have been struggling and consumers are extremely value conscious. Stores are reporting that people are only spending money on necessities. Friday, retail sales will be released and that number could weigh on the market. Furthermore, retailers will be reporting earnings over the next two weeks.

As earnings season winds down, economic releases will once again be the focus. All hopes of an economic recovery are tied to China. This morning, they reported that industrial output eased to 24.9% 25.5%. This was below estimates, but not dramatically. Yesterday, they announced that their trade surplus decreased. There was a substantial decline in imports and that signals a slowdown ahead.

Most of last year's economic rebound can be attributed to an inventory rebuild. Yesterday, wholesale inventories rose .1%. Sales dropped dramatically to a 15-month low. This tells me that the inventory cycle has run its course and we will start to see a decline in manufacturing.

September and October are seasonally the weakest months for the stock market. Fear starts to creep in by the end of August and judging today's action, traders might be getting a jump on that pattern.

Options are relatively cheap and this is a good time to start buying October out of the money puts. I still think we are little early so scale in and plan on taking a little heat during the next few weeks. Focus on stocks that are highly leveraged (REITS, Biotechs) and companies that are dependent on Asian growth (commodities, cyclicals). These stocks have performed well in recent months and they could fall dramatically if my forecast plays out.

A dismal initial jobless claims number tomorrow and disappointing retail sales on Friday could push this market lower the rest of the week. If the SPY closes below 109, a "lower low" will have resulted and it is safe to say that resistance at SPY 113 will hold through at least October.

European credit concerns have subsided. If this reignites, the selling could accelerate. The major structural issues still exist and until they are addressed, the potential for a credit crisis looms. If this fear does NOT resurface, we will have a fairly normal decline of 15%+. If it does materialize, we could fall much further. Buy some puts today.

Daily Bulletin Continues...