Quiet Trading With Increasing Selling Pressure Into Labor Day! Start Buying Puts!

Each of the last two weeks has been marked by an explosive move and a lack of follow-through. Trading volumes will decrease next week as earnings season winds down and economic releases subside. Traders are taking time off before their children go back to school and we are likely to see lackluster price action.

Yesterday, the market was able to shake off a bad round of news and it stopped the bleeding from Wednesday's 35 point decline in the S&P 500. Cisco released earnings and this optimistic tech giant suddenly changed its tune. The CEO has been steadfast in his belief that an economic recovery is well under way and now, he's not so sure. The market sold off Wednesday after hours, but it was able to recover prior to yesterday's open.

A week ago, initial jobless claims spiked to 479,000. That was much higher than expected and it was largely discounted as a "one-off" event. Yesterday, initial jobless claims rose to 484,000. This is the second bad number in a row and it signals weakness ahead.

I've been mentioning this week that retail sales could weigh on the market. We know that auto sales have been good and that helped revenues rise by .4%. If you strip out autos and gasoline, retail sales actually declined .1%. Department stores have been posting results and the guidance is weak. Kohls, Nordstrom's and JC Penney are all trading lower after their earnings releases. Consumers are tightening their belts and we heard that from Proctor & Gamble and Colgate two weeks ago.

This morning, consumer sentiment rose slightly after posting its biggest decline last month. Jobs are tight and the confidence is low. Over 70% of our GDP is dependent on spending. As Americans tighten their belts, business inventories are growing. This morning, they rose to their highest level in a year. Demand is soft and this will keep companies on the defensive.

Last month’s private sector employment growth will not continue. We will get a peek at it two weeks from now when ADP releases its figures. I believe July’s private sector job growth will reverse in August. The ADP number precedes the Unemployment Report and I will be watching it carefully.

As I've been mentioning this week, the inventory cycle has run its course. It has provided a false sense of security since many analysts felt that demand was growing. Now they will realize that it was just a rebuild in inventories.

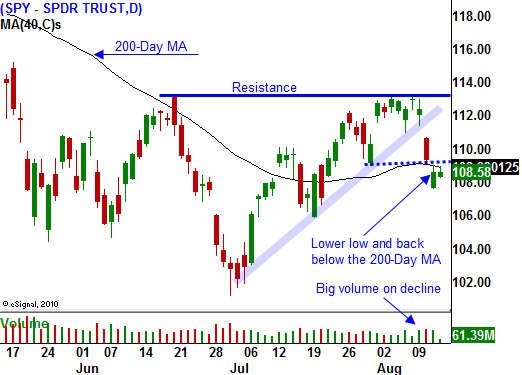

The upward market momentum stalled this week and resistance has been established at SPY 113. I believe that is the highest level we will see in the next two months. The market is back below its 200-day moving average and we closed below SPY 109 (a lower low).

With each passing week, the selling momentum will pick up steam. Weaker companies will be releasing earnings, the inventory cycle has run its course, economic conditions are continuing to deteriorate and the weakest seasonal period for stocks is approaching. The table is set for a retest of major support at SPY 105.

Seasonality alone would be a bear trap, but we have all of the other elements in place to generate a market decline. This week, we saw how dependent global markets are on China's economic activity. In two weeks, they will release their PMI and I believe it will fall below 50 indicating economic contraction. That same week, ISM manufacturing and ISM services will be released (both have been declining) along with the Unemployment Report. Initial jobless claims have spiked the last two weeks and this is setting up to be a nasty number.

I am starting to buy out of the money puts in October. Heading into Labor Day, we could be poised for a serious selloff and I am preparing now. I know that I am early, so I am scaling in. Once the decline starts, option implied volatilities will jump and option bid/ask spreads will widen out. This makes it difficult to enter positions. Consequently, I am willing to take a little heat on my positions now so that I am not scrambling to get in when the @#$% hits the fan.

Expect quiet markets with increasing selling pressure the next two weeks.

Daily Bulletin Continues...