The Numbers Were Not Bad Enough To Force A Sell-off. Scale Out of Put Positions This Week!

My forecast during the last month pointed to a decline that would start this week. Dismal economic numbers were going to result in a selloff, but they did not. They were weak, but the market is moved higher on the releases.

A concerning trade balance report in China two weeks ago showed that imports had declined substantially. Manufacturers had cut back on supplies and I believed production would fall. The PMI in China has been declining for months and I forecasted that it would dip below 50. Consensus estimates were 52 and it came in at 51.7. It missed estimates, but it was better than the 51.2 reported in July. Stocks in China rallied on the news.

Australia's economy grew at the fastest pace in three years and GDP climbed 1.2%. This number is still fairly weak, but Asian stocks rallied on the news.

The PMI in the EU hit a six-month low dropping to 55.1 from 56.7 in July. Manufacturing growth slowed in Germany, but it grew more than expected in France. That has the CAC 40 trading up almost 2%. Germany's unemployment improved and 17,000 jobs were added. Its unemployment rate stands at 7.6%. The DAX is up 1% on the news. This news was not good and the market’s reaction reveals an underlying bid for stocks.

The ADP employment index showed that 10,000 jobs were lost in the private sector. Consensus estimates were for 15,000 new jobs. This was a substantial miss and the market barely even flinched. Our economy needs corporations to hire and they are not expanding payrolls. We already know that the public sector will shed many jobs. At least 100,000 census workers will be laid off. State and local governments are slashing payrolls and Friday’s Unemployment Report will be worse than expected.

Unfortunately for us bears, the market probably won't decline on a horrible report on Friday. Equities are attractively valued and it will take incredibly bad news to topple this market. Balance sheets are strong, profits are excellent and fixed income yields are ridiculously low. Dividend yields on many stocks are higher than the yield on bonds and investors have upside potential if equities rally.

Conditions would have to change rapidly for us to see a substantial decline. Corporate guidance would have to be slashed, consumption would have to dry up completely or we would need an actual sovereign default in Europe. These are major events. Gradual economic deterioration alone won't produce a major market selloff.

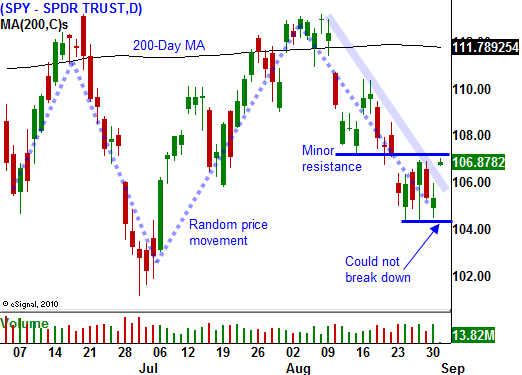

So, where do we go from here? The market has been in a 100 point range on the S&P 500 during the last year. We are likely to see a small decline from September-October. The selling will be rather contained as investors buy stocks ahead of the November elections. Starting in late October, we will see a nice year-end rally up to SPY 115.

Investors will eventually get tired of lending money to our government for 10 years at a rate of 2.5%. Should economic conditions show any signs of life, investors will shift into equities.

We got a fairly disappointing round of economic news, yet the market rallied. This tells me my forecast is wrong and that we need to adjust our positions. ISM manufacturing will be released 30 minutes after the open and I believe it will be weak. This does not mean that the market will have a sustained decline.

I am going to scale out of my longer-term put positions and reduce my risk exposure by half heading into the weekend. I will also start selling out of the money puts on strong stocks. I still feel that we have a round of weak economic news ahead of us and we should be able to lock in nice profits on bearish positions. In this back-and-forth market, I do not want to let profits slip away.

Daily Bulletin Continues...