Bears Need A Breakdown Tomorrow!

It's not unusual for people to be nervous before they make a big purchase or to have a tooth ache feel better just before they get to the dentist's office. These same defense mechanisms kick in and toy with a trader's psychology. You've gathered information and made a sound decision, but you start second guessing yourself before the event. For the last month, I have been waiting for this moment because I believe the probability for a breakdown is high. I did not like the price action the last two days and I had to zoom out to a longer timeframe to regain my confidence.

Last Friday, the market rallied on good volume after the Fed Chairman said that our economy is not likely to see a double dip recession. If conditions warranted, they were ready to do whatever is necessary. His statements did not reveal anything new, yet the market took off. Yesterday, those gains were erased, but the decline came on very light volume. That type of price action concerns me because the market declines have come on strong volume.

The other concern I have is that many analysts share my forecast. They are looking for a decline over the next six weeks and a rally into year-end. When opinions converge, the market has a habit of disappointing the most people.

This morning, Chicago PMI came in much worse than expected. It dropped to 56.7 in August from 62.3 in July. This was much lower than the consensus estimate of 60, but the market held strong after the weak number. Minutes later, consumer confidence rose to 53.5, up from 51.0 in July. The S&P 500 rallied 10 points on the news. Confidence is still very low and it takes a reading above 90 to indicate a healthy economy. This type of price action is damaging to my bearish forecast because bad news is being discounted by the market.

Corporate earnings have been excellent and balance sheets are strong. M&A activity is picking up and companies are putting some of that cash to work. Mutual funds have seen huge money flow into fixed income and not equities. This reflects overwhelming bearishness on the part of investors. Interest rates are low and inflation is nonexistent. These are all very strong bullish arguments and they are keeping a bid to this market.

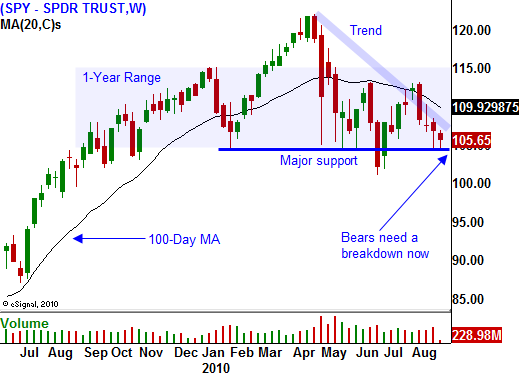

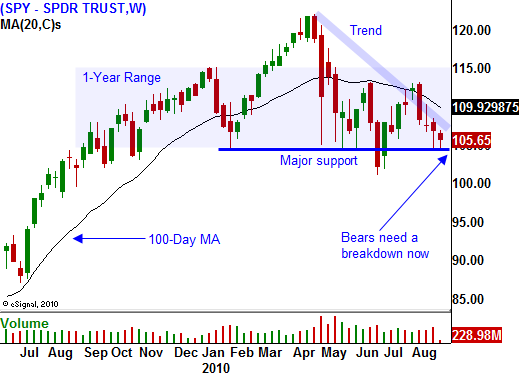

In today's chart, you can see that the market has been in a range from SPY 105 - 115 (except for one small breakout) for the entire year. We are sitting just above major support and bears have not been able to penetrate 105. We need to see a close below SPY 105 tomorrow or this market is likely to bounce.

I still believe that China's PMI will fall below 50 when it is released overnight. However, that doesn't mean the market will have a negative reaction. Perhaps traders will argue that China will stop raising its bank reserve requirements and it will take its foot off of the breaks. China knows that its growth is reaching speculative levels and it wants to avoid a "real estate bubble". I don't believe they will stop tightening, but it's not my opinion that counts. If trader's discount this event, we have to be prepared to cover our shorts.

Yesterday, Goldman Sachs lowered its forecast for private sector employment. It now believes (like I do) that private sector job growth will be flat. Now, traders might be pricing in a bad employment number.

Retailers will be releasing same-store sales results Thursday. Most have lowered Q3 guidance and dismal "back-to-school" sales could be priced in. During yesterday's market decline, retailers held up fairly well.

I still believe that economic conditions will continue to deteriorate and unemployment will rise. This will weigh on consumption and a double dip will result. Credit issues in Europe will grow, but the crisis might not come to a head for many months.

The good news is that my forecast could be correct. The market's reaction to the overnight news will tell us exactly where we stand. If China's PMI falls below 50 and we can't close below major support at SPY 105, the market will bounce and we need to take profits on our short positions. On the other hand, if the news creates major selling pressure, the breakdown will force many people out of the market.

Overconfidence is not a healthy trait when it comes to trading. The market will humble you whenever possible and you need to have a contingency plan in case your forecast does not play out.

You should have excellent profits at this stage. I have been encouraging you to take larger than normal positions so the risk exposure is elevated. We bought longer term October puts so that we can stick with positions if we get a breakdown. If we do not drop, take profits and reduce your exposure.

We are at the brink of covering short positions and making a little money or hitting a home run. Tomorrow we will know which camp we are in.

Daily Bulletin Continues...