Bulls Want To Buy A Dip. We May Not See A Big Pullback!

The market continues to grind higher and bulls clearly have the momentum. Seven out of the last eight trading days have been bullish.

For every bullish shred of economic data, there are two or three negative data points. Money is rotating out of bonds and into stocks and as long as conditions are not horrible, this will continue.

Yesterday, initial jobless claims came in much better than expected. However, 10 states (including major states like California) did not report due to the holiday and new claims were estimated. This means we could see a downward revision next week.

This morning, Obama is delivering his economic plan for the second time this week. The speeches have more to do with campaigning than economics. He knows that Americans are dissatisfied and he wants to place the blame on Republicans ahead of November elections. Democrats control the White House, the Senate and the House of Representatives. The problem has been flawed economic plans, not Republicans.

Cash for clunkers was a waste of money. Good vehicles were destroyed and taxpayers subsidized an inefficient auto industry that deserved to fail. Tax rebates were used to pay down debt and the money did not make it back into the economy. Unemployment benefits have continually been extended and there is no rush to go back to work. High-speed trains work well in Europe and Asia where population densities make it efficient. In the United States, it is a waste of money and it won’t create jobs. If people want to get from Chicago to St. Louis faster, they can choose from a dozen daily flights and stretch out in a half-empty plane. We've already seen the government's inability to run Amtrak (or the US Post Office).

At the 12th hour, the president is finally providing investment tax credits for small business. That is a program that will stimulate long-term investment. He knows that Republicans would favor this action and he is leveraging this proposal against them. The election rhetoric is heating up and we can expect weekly speeches.

Next week, we will get a nice round of economic releases. Retail sales, business inventories, Empire Manufacturing Survey, industrial production, initial claims, PPI, Philly Fed, CPI and consumer sentiment will be released. I believe conditions will continue to slowly deteriorate and the news will not be bad enough to spark a selloff.

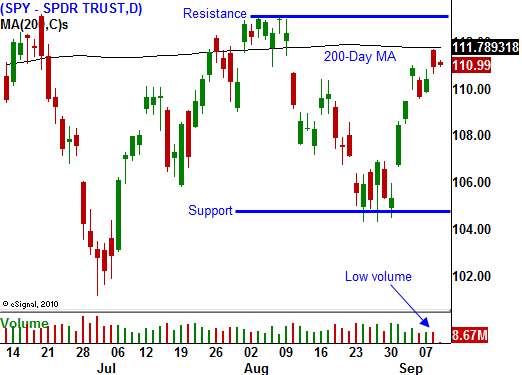

Trading volumes have been light and the only thing keeping a lid on this market is overhead resistance. We are bumping up against the 200-day moving average and major horizontal resistance sits just above that at SPY 115. Asset Managers are buying ahead of November elections and they do not want to miss a year-end rally. Bond yields are at historic lows and rotating into equities has been a no-brainer.

I am hoping for a pullback so that I can buy calls. Unfortunately, everyone else is waiting for that same pullback. That means it might not come. If the SPY closes above 112, buy calls.

I am still long-term bearish, but I will trade the current momentum. Eventually, massive debt levels in Europe and the US will result in a credit crisis. Structural issues will not be addressed and each year we will sink further and further in to debt as the population ages. States are in a similar situation and deficits will continue to escalate. Americans are tapped out and they have very little saved. These problems will grow at an alarming rate in the next few years and we are close to breaking point.

For now, follow the money and try to get long. This rally will probably last into the first two weeks of Q3 earnings season. Given my long term forecast, I WILL NOT TAKE BIG BULLISH POSITIONS.

Daily Bulletin Continues...