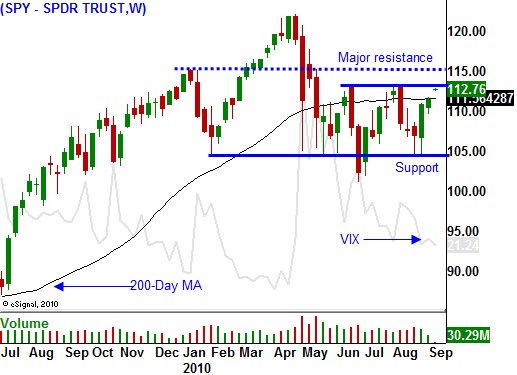

The Market Has Broken Out Above the 200-Day MA. Now it Will Test major Resistance At SPY 115

Last week, the market continued to push higher, but it was not able to rise above resistance. This morning, positive news overseas provided a strong backdrop and the market has broken out above the 200-day moving average.

China's industrial output rose 13.9% year-over-year and that is better than the 13.4% increase we saw in July. Analysts had expected a rise of 13%. Asian markets were up more than 1% overnight.

A European commission released a report and they now believe that EU growth could hit 1.7% this year. That was much better than previously forecasted .9% growth. Germany, the largest economy in Europe, accounted for much of the growth. European markets were also up more than 1%.

This week will be filled with fairly important economic releases. Retail sales, business inventories, Empire Manufacturing, industrial production, initial claims, PPI, Philly Fed, CPI and consumer sentiment will influence trading. Many of these releases focus on manufacturing and I believe the numbers will be fairly weak. However, the market has been able to discount this news in recent weeks. The inflation statistics might show a rise in prices. China's CPI rose by .6% last month and PPI rose .4%. Prices have been moving higher around the globe and inflation might start creeping into our economy.

Now that the market is above its 200-day moving average, it will challenge major resistance at SPY 115. If a gradual rally unfolds, option buy programs could push the market higher ahead of expiration. Seasonal weakness has not been a factor and Asset Managers are buying stocks ahead of November elections. They don't want to miss a year-end rally so they will aggressively bid for stocks.

Bond yields are at historic lows and money is starting to rotate out of fixed income and into equities. With many companies paying nice dividends, dividend yields have risen to the point to where they exceed the interest rate being paid on a 10-year U.S. Treasury. Investors that buy high-yield stocks get the income and the chance for price appreciation. As more money shifts into equities, confidence will grow and investors will also start buying stocks.

The seasonal weakness we would normally see in September and October came in August. The year-end rally that normally comes in November and December is starting now. I believe the market will stage a nice rally through October. The elections will pass and halfway into earnings season, the excitement will wane. That means that trading could settle down late in the year.

For now, the upward momentum is very strong. Economic conditions continue to deteriorate, but this is not weighing on the market. As long as China remains strong and EU credit concerns are contained, money will continue to rotate into equities.

My long-term perspective is still very bearish. Massive debt levels will eventually lead to sovereign defaults. As severance packages and unemployment benefits run out, consumption will fall during this jobless recovery.

This bearish long-term forecast influences my short-term trading approach. I am keeping my positions fairly small and I am buying calls. This limits my downside risk exposure to the premium I pay for the options and I'm still able to capitalize on the run-up. Option implied volatilities have also declined and option premiums are reasonable. Healthcare and tech have been badly beaten down and I am finding good opportunities in these sectors.

I'm expecting the market to grind higher today and it should close near its highs. Retail sales will be fairly dismal, but better than expected tomorrow morning. These stocks are trading near the low end of their ranges and they could move higher after the release. This should provide positive action tomorrow morning.

Daily Bulletin Continues...