We Are Seeing Strong Rotation Out of Bonds and Into Stocks. The Market Wants To Move Higher

In the last week, the market has rallied over 6%. Economic releases have been mixed and there are many conflicting statistics. Conditions are not horrible and money is rotating out of bonds and into stocks.

The fireworks started last week when China's PMI improved slightly after declining for many months. It is barely above 50 and if it falls below that level it will signal economic contraction. The number came in below estimates, but it was not horrible. This week, China ordered steel manufacturers to stop production for 20 days. They see a decline in demand and they do not want to overproduce. This news was ignored by the market even though it signals weakness ahead.

The ADP employment index was released a week ago and it showed a decline in private sector jobs of 10,000. Analysts had expected 13,000 new jobs and this was a substantial miss. The news was completely dismissed and the market continued to push higher in pre-open trading. ISM manufacturing jumped to 56.3 and estimates were 52.9. This "good news" sparked massive buying and the market rocketed higher.

The buying continued Thursday and Friday even though the news was rather dismal. Initial jobless claims decreased slightly from prior weeks and that was seen as a positive even though the number was fairly high. The Unemployment Report showed that 54,000 jobs were lost in August. That was much better than the 120,000 job losses that were projected. Again, the market rallied on the mediocre number because worst case scenarios were priced into the market. Contrary to ADP (a company that processes corporate payrolls), the government’s calculations showed that private sector jobs grew by 67,000.

After Friday's open, the ISM services number was released. It declined to 51.5 from 54.3 and the drop was much greater than expected. ISM manufacturing sparked a huge market rally even though it only accounts for 20% of our economic activity. On the other hand, the service sector accounts for 80% of our economic activity and the market didn't even flinch after the miss.

This week, credit concerns in Europe resurfaced. Interest rates in Ireland, Greece and Portugal have climbed higher. Higher yields attracted buyers and the market is satisfied with the participation in the bond auctions. Higher interest rates in PIIGS countries could not dampen spirits and the market pushed higher.

Yesterday, the Beige Book showed gradually deteriorating economic conditions. Traders once again looked for the silver lining and stocks moved higher. Obama outlined his economic plan in the afternoon, but his speech turned into an election campaign. He dared Republicans to stand in the way of this economic bill. He was steadfast in letting the Bush tax credits expire for the wealthy. The market also took this news in stride.

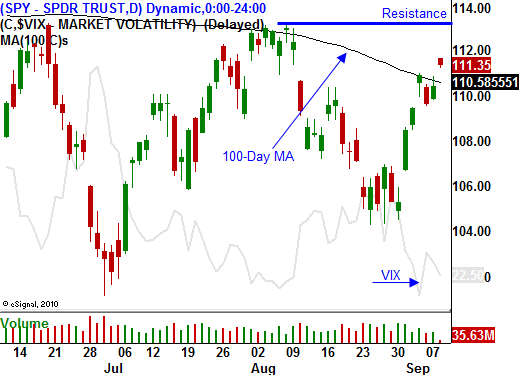

This morning, we actually got decent economic news. Initial jobless claims came in at 451,000 when analysts expected 470,000. The market is trading higher, but it has bumped up against resistance at the 200-Day MA.

The price action that we've witnessed in the last week tells me that stocks want to move higher. As long as the news is not dreadful, buyers will shift from bonds to equities. Interest rates are near historical lows and dividend yields in many cases are higher than the yield on the ten-year bond. Asset Managers have renewed confidence and they are buying stocks ahead of the November elections. Seasonal strength that would normally start towards the end of October is kicking in weeks ahead of schedule.

I still believe that economic conditions will continue to deteriorate. The Fed and the government will try to prop activity up, but their efforts won't produce results. Quantitative easing has not worked and the stimulus programs have not created jobs. The market will embrace these moves and that backstop will give investors confidence to buy stocks.

I also believe that credit concerns in Europe will escalate. These countries are faced with structural problems and as workers retire the deficits will grow exponentially. The IMF and ECB will race to the rescue as long as they feel the problem can be contained. Sovereign governments will promise to cut expenses and balance budgets. This process can continue for a long period of time but it will eventually reach a breaking point.

My longer-term bearish forecast is still intact. Massive debt and structural budget problems will run their course in the US and Europe. When we hit that breaking point, things will get ugly.

On a short term basis, the timeline for a year-end rally has been moved forward. I will not chase this 6% one-week rally. I will wait for a pullback and I will buy calls on strong stocks. The VIX has dropped back into the low 20’s and this is an option buyers market. Call buying also has the added benefit of finite risk. If the rug does get pulled out, the most you can lose is the call premium.

It appears we will not have a big pullback in September, so I am not looking for a big year-end rally. I believe prices will move higher ahead of the elections and then the rally will stall. Resistance at SPY 115 is heavy and that will be the first challenge.

Daily Bulletin Continues...