Retail Sales Were Better Than Expected – Market Continues To Grind Higher

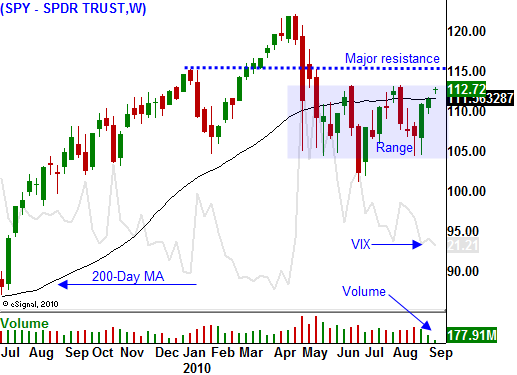

Last week, the market continued to push higher, but it was not able to rise above resistance. Yesterday morning, positive news overseas provided a strong backdrop and the market has broken out above the 200-day moving average.

China's industrial output rose 13.9% year-over-year and that was better than the 13.4% increase we saw in July. Analysts had expected a rise of 13%. Asian markets were up more than 1% overnight.

A European commission released a report Monday and they now believe that EU growth could hit 1.7% this year. That was much better than previously forecasted .9% growth. Germany, the largest economy in Europe, accounted for much of the growth. European markets were also up more than 1%.

This week will be filled with fairly important economic releases. Retail sales, business inventories, Empire Manufacturing, industrial production, initial claims, PPI, Philly Fed, CPI and consumer sentiment will influence trading. Many of these releases focus on manufacturing and I believe the numbers will be fairly weak. However, the market has been able to discount this news in recent weeks. The inflation statistics might show a rise in prices. China's CPI rose by .6% last month and PPI rose .4%. Prices have been moving higher around the globe and inflation might start creeping into our economy.

Now that the market is above its 200-day moving average, it will challenge major resistance at SPY 115. If a gradual rally unfolds, option buy programs could push the market higher ahead of expiration. Seasonal weakness has not been a factor and Asset Managers are buying stocks ahead of November elections. They don't want to miss a year-end rally so they will aggressively bid for stocks.

Bond yields are at historic lows and money is starting to rotate out of fixed income and into equities. With many companies paying nice dividends, dividend yields have risen to the point to where they exceed the interest rate being paid on a 10-year U.S. Treasury. Investors that buy high-yield stocks get the income and the chance for price appreciation. As more money shifts into equities, confidence will grow and investors will also start buying stocks.

The seasonal weakness we would normally see in September and October came in August. The year-end rally that normally comes in November and December is starting now. I believe the market will stage a nice rally through October. The elections will pass and halfway into earnings season, the excitement will wane. That means that trading could settle down late in the year.

For now, the upward momentum is very strong. Economic conditions continue to deteriorate, but this is not weighing on the market. As long as China remains strong and EU credit concerns are contained, money will continue to rotate into equities.

My long-term perspective is still very bearish. Massive debt levels will eventually lead to sovereign defaults. As severance packages and unemployment benefits run out, consumption will fall during this jobless recovery.

This bearish long-term forecast influences my short-term trading approach. I want to find strong stocks with rich premiums so that I can distance myself from the action. If we do get a pullback, I will consider buying calls once support is established.

Retail sales came in better than expected this morning and that should provide support. This sector is trading near the low end of its 1-year range and these stocks have room to run. I expect the market to grind slightly higher this week now that we are above the 200-day MA. Resistance at SPY will be the next challenge.

Daily Bulletin Continues...