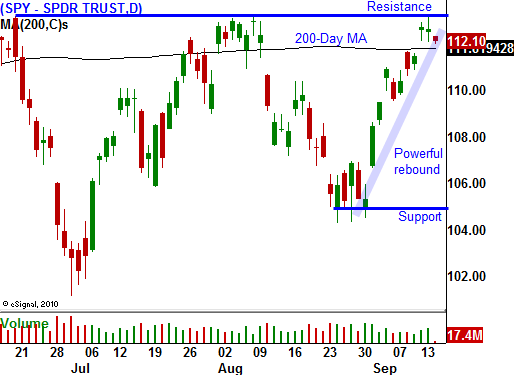

The 200-Day MA Is Holding. Buy Some Calls Now and Wait For A Dip.

This is shaping up to be a very quiet week. There are many economic releases, but they are not packing much punch. That is good news for bulls.

This morning, Empire Manufacturing fell to its lowest level in more than a year. It dropped from 7.1 in August down to 4.1 in September. Manufacturing continues to decline in the Northeast, but the reading was still above zero. This morning, import and export prices were also posted. Import prices rose .3% largely because of higher petroleum costs. This might signal that tomorrow's PPI will also come in a little "hot".

The decline in manufacturing should have weighed on the market, but it did not. After an early decline, the market has bounced right back into positive territory. This price action is very bullish and we've seen it the last few days. Now that we are above the 200-day moving average, the momentum clearly favors the bulls.

Overnight, Japan intervened in the currency markets. They are selling the yen in an effort to devalue it. A strong currency is hurting Japan's exports and for the first time in six years, they are taking action.

Perhaps the most interesting news this morning was that Wilbur Ross (along with Carlyle and Cardinal Group) is buying a trouble Irish Bank. He is a cautious "value investor" and he believes Ireland will get its act together. They have aggressively addressed deficit problems and he believes they will balance budgets.

This market is manic-depressive. It swings from overly pessimistic to overly optimistic in a matter of weeks. For now, the silver lining is discovered in every release. Tomorrow, the PPI, initial claims and the Philly Fed will be released. I believe PPI will come in a little "hot", initial claims will reverse last week's bullish number (remember 10 states had to estimate new claims) and the Philly Fed will be a little better than last month's horrendous reading. All told, the news should be relatively neutral.

The momentum points higher and option expiration could provide a boost as buy programs kick in. Asset Managers are hoping for a dip so that they can buy stocks. The longer we go without a pullback, the less likely we are to have one. The bids will get more aggressive since Asset Managers don't want to miss a year-end rally. They also want to get long ahead of the November elections.

I like technology and medical devices. These stocks have been beaten down and they have room to run. A sustained market rally will not unfold without tech stocks. Option premiums are declining and this is a good time to buy calls. We are above the 200-day moving average and confidence is growing. That means money will shift out of bonds and into stocks.

Buy some calls now and wait for a pullback to buy more. If the market does not decline in the next week, add to positions.

I still believe that massive debt levels will cause problems in the future. As a result, I am keeping my call purchases fairly small. I want to play this rally, but I don't want to be overexposed.

Look for choppy trading today with the chance for a small rally into the closing bell.

I will be hosting a 2-hour Live Webinar tonight. It will include extensive market analysis and two new option trades. If you sign-up and can't attend, a recording of the presentation will be e-mailed.

Daily Bulletin Continues...