The Market Got What It Wanted From The Fed – No Follow Through Rally!

Yesterday, the market chopped around the head of the FOMC statement. Traders wanted more hints of quantitative easing and the Fed obliged.

They stated that economic conditions are deteriorating and that they will maintain their current "easy money" policies. The Fed is also prepared to do whatever it takes to keep this recovery on track. That means another round of quantitative easing (QE2) could be close at hand. The news was well received and the market moved higher.

Bulls should be rejoicing, but the market is drifting lower this morning. An easy money policy by the Fed will hurt the dollar. The idea is that American goods will be cheaper relative to foreign goods and that will increase our exports. Europe has benefited from a weak Euro and they do not want to see the dollar devalued. Similarly, Japan started selling yen last week and it intervened for the first time in over six years. We know that China is trying to keep its currency "cheap" by pegging it to the dollar. Every country is trying to devalue its currency and the gush of cheap money will eventually lead to inflation.

Currencies are a zero sum game and when one currency devalues, another must rise on a relative basis. It will be interesting to see how this all plays out. I believe the Eurodollar will devalue the most because of credit issues. It is a huge challenge to unify 16 nations when some are fiscally responsible and some are not. The US dollar will be a close second. We continue to spend more than we collect and our entitlement programs pose a structural problem. Japan has astronomical debt levels, but that debt is almost entirely held by Japanese investors. They have a high savings rate and I believe efforts to devalue the yen will fail.

A cheap dollar might sound like a good idea, but it comes at a cost. All imports would become more expensive and that is very inflationary. When we go to spend our hard earned money, we will find that our purchasing power has declined. Real estate will become relatively cheap and we can expect a great deal of foreign investment.

Countries that are prosperous and balance their budgets have strong currencies. The market might want to hear that QE2 is being considered, but in the end, traders know that it won't stimulate our economy. Banks are content playing the wide spread between borrowing and lending rates. They have no desire to go out and compete for new business. We can't force them to lend money, but we can take this pacifier away.

I would like to see interest rates move higher. They are artificially low and the banking crisis has passed. Businesses aren't getting loans as it is and if banks have to fight to make money, they will consider worthy loans. Higher interest rates will also give the Fed more firepower in the future. Right now, they are painted into a corner and short-term rates are almost at zero. Higher interest rates would also signal that the economy has formed a base.

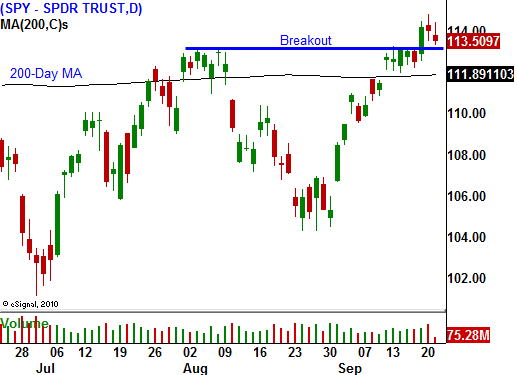

The market has broken out above resistance at SPY 113 and it is within striking distance of major resistance at SPY 115. Conditions are overbought after an 8% rally in a matter of weeks. The next few points will be hard fought and the market might need time to gather strength before it makes its next move higher. Initial jobless claims will be released tomorrow and they have improved two weeks in a row. Analysts are expecting 450,000 new claims and that would be a "market friendly" number. Friday, durable goods orders will be released. They have been dismal for three months in a row and the expectations should be low. That means any surprise is likely to come on the upside. I'm not expecting a big rally off of either of these numbers, but the market should be able to tread water.

Next week, ISM manufacturing, ISM Services, ADP Employment, China’s PMI and the Unemployment Report will be released. I doubt the market will be able to move through major resistance ahead of those numbers. That will be a pivotal week since the market will either back off from resistance or breakout.

Daily Bulletin Continues...