No News Is Good News. Lighten Up On Bullish Positions!

No news is good news. The market continues to tread water and there aren't many economic releases to stand in its way.

This morning, consumer confidence fell to its lowest level since February. It came in at 48.5 and analysts were looking for 53.2. People are pessimistic because they are out of work. Severance packages and unemployment benefits are running out and the purse strings have been tightened. The market was prepared for a bad number and after an early decline, prices rebounded.

Yesterday, the market tested the downside early in the morning. When bears could not get anything going, the market rallied back. This is a sign that buyers are looking for entry points. Each decline is short-lived because Asset Managers are bidding for stocks.

There are rumblings in Europe, but the market is not overly concerned. Ireland might lose its credit rating and the ECB wanted to inject money, but it doesn't have the power to do so. The borrowing nation must request the aid. Bond auctions in Spain saw a bid to cover of 2, down from last month's 3.9. Interest rates climbed higher, but the market was satisfied with the results. The bottom line is that European credit concerns won't topple the market until we have an actual sovereign default. That could take many months.

Tomorrow will also be a quiet trading day. We don't get any economic numbers until Thursday. These releases should be weak, but in line with estimates. Friday is the day to watch. I believe China's PMI will decline and a soft ISM manufacturing number will spook investors. I am not looking for a massive selloff, just a normal correction. This move will run its course and buyers will support the market next week.

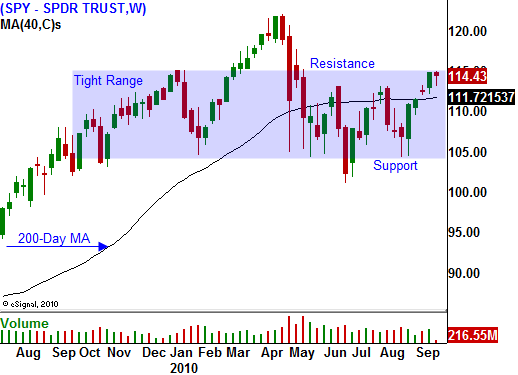

We're up against a major horizontal resistance level and this is a perfect opportunity to lighten up on positions. If the market breaks out, you can always get back in. We have seen random 8% moves in both directions and you have to take profits when they present themselves in this market. Trading volumes are light and the upward momentum has faded.

I am scaling out of my call positions and I am going to cash. I want to get through the next two weeks and then I will look to reenter long positions. Many bulls are looking to do the same and I believe any pullback will be brief.

Look for lackluster trading until Thursday. Take this opportunity to lighten up on your bullish positions.

Daily Bulletin Continues...