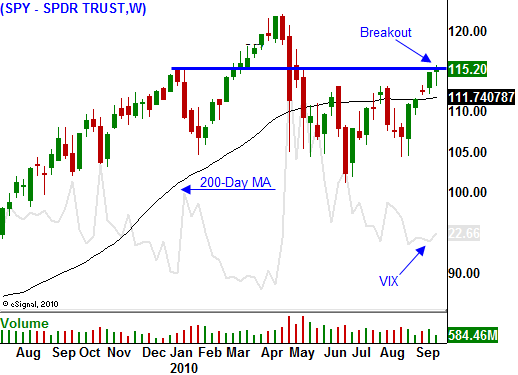

Sellers Were Able To Beat Stocks Back Below SPY 115. Watch The Late Day Action

The market has very quietly been grinding higher in the last week. Typically, prices move lower early in the day and buyers step in late in the afternoon. We have gradually been inching closer to major resistance at SPY 115, but we have not had a catalyst to push us through.

This morning, Q2 GDP rose to 1.7% from 1.6%. That was better than expected. Initial jobless claims came in at 453,000. The four-week moving average has dropped below 460,000 and while that is not cause for celebration, the market is content with the number. Chicago PMI jumped to 60.4 from 56.7. The forecast was 56.0 and this number sparked a nice rally this morning.

The SPY is breaking out above major resistance at 115. If it can close above this level for two days, we are likely to see a rally to the highs of the year. Asset Managers have been waiting for a pullback so that they can "buy in". That pullback has not materialized and now they are getting anxious. They don't want to miss a year-end rally and they know that there are many positive influences that could push the market higher.

Earnings season is just around the corner and stocks have rallied ahead of announcements for four straight quarters. November elections should favor Republicans and that is also bullish for the market. The Fed stands ready with another round of quantitative easing should conditions deteriorate and that backstop is also giving traders confidence.

Money has been flowing into bonds and this flight to safety has pushed yields down to historic lows. Many dividend yields are higher than the yield on 10-year US Treasuries. Investors are buying these stocks because they can generate the same level of income and they can profit from price appreciation. Corporations are issuing debt and they are using the proceeds to buy back shares. On a relative basis, stocks are cheap and this asset rotation should continue.

The only potential problem I saw this week turned out fine. China released its PMI and it came in better than expected at 52.9. As long as their growth is intact, global markets feel that the recovery is sustainable.

Tomorrow, consumer sentiment, construction spending and ISM manufacturing will be released. Earlier in the week consumer confidence was negative and the market shrugged it off. Consumer sentiment will likely be weak and that is already factored into the market. For that matter, construction spending will also be weak and any surprise would be to the upside. ISM manufacturing spiked last month and I believe the number will be revised lower because it was not consistent with other manufacturing releases. Given today's positive Chicago PMI, even a weak ISM manufacturing number tomorrow probably won't result in much of a selloff.

Next week, factory orders, ISM services, ADP employment, initial claims, wholesale inventories and the Unemployment Report will be released. ISM services came in very weak last month and that could be the number to watch when it is released Tuesday. The service sector accounts for 80% of our economic activity. The employment statistics should be decent since initial jobless claims have been improving the last four weeks. Even though the economic releases are dismal, they are not bad enough to spark a selloff.

Credit conditions in Europe are worsening and the market does not care. It is discounting the likelihood of a sovereign failure. Interest rates in Portugal and Ireland are rising quickly and those countries will be the next trouble spots. This problem will fester and it will lead to a future credit crisis. That could be many months away and for now; the market is not worried about a sovereign default.

The market broke out above key resistance at SPY 115 and now it has backed off. There should be plenty of selling pressure at this level and it will not be easy to breach. The late day action will be important to watch. If 115 can hold through Tuesday’s ISM services number, there is a likely hood that the market will run up to SPY 122 in the next month.

I am long calls on laggards that have excellent earnings and are rallying off of solid support levels. These stocks have the most upside potential since they have not run up during the recent rally. If I see late day strength, I will add to these positions. If the market pulls back below SPY 115, I will wait for the breakout.

Daily Bulletin Continues...