The Bid Is Weakening. Asset Managers Will Not Chase Stocks Ahead of Major News!

The market is starting to lose some of its momentum and we are seeing two-sided action. When stocks try to break out, they eventually attract sellers. The same is true for the flipside. Yesterday, stocks tested the downside early and rallied late in the day.

This directionless trading should be expected ahead of major news events. No one wants to stick their neck out when the market could break out to new highs or rollover. The election results will be known next Wednesday morning and that afternoon, the FOMC will release its statement.

Traders are expecting Republican victories and at very least, they should win back the House. There is less than a 50% chance that they will also control the Senate. These results are already priced in. If Republicans win the House and the Senate, we will test the highs of the year. On the other hand, if they barely squeak out control of the House, the market is likely to pull back.

The tone will be set for the FOMC statement. I believe it has the potential to disappoint. The consensus in a recent poll expects a $500 billion monetary injection. I believe the Fed will proceed cautiously and the first round of QE2 will be in the $200 billion range. If the market is trading higher on Republican victories, the Fed's action will simply soften some of the optimism. Traders will not like the news initially, but they will embrace the "slow and steady" approach. If by chance Democrats fare well in the elections, the Fed's action will be a "double whammy" and stocks are likely to pull back sharply.

This morning, durable goods orders rose by 3.3% and that was better than expected. However, excluding transportation, they fell .8%. This was not a good number and aircraft orders masked the weakness. As I mentioned yesterday, this release would not impact the market. The S&P 500 was down before the news and it did not move after durable goods orders were posted. Initial claims tomorrow and GDP on Friday will also have a minimal effect. Consensus estimates for Q3 GDP are 2%.

Growth in Asia is important to our rally. South Korea, the fourth-largest economy in Asia, reported 4.3% GDP growth. That is a relatively strong number and it supports economic expansion in that part of the world.

The overnight earnings were decent, but the reaction was mixed. This simply means that the expectations are high and investors are taking profits after the release. This is a typical pattern in the middle of the earnings cycle and stocks are getting tired.

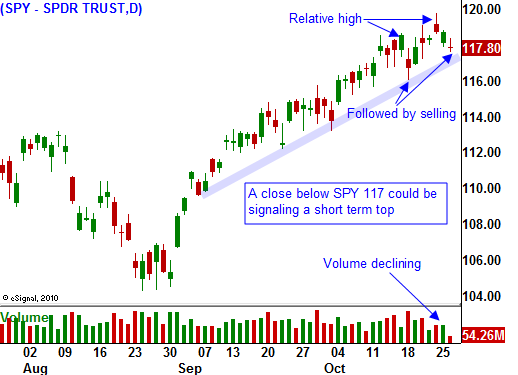

The S&P 500 is down 10 points this morning and it feels like it could drift lower. After a 14% run-up in a matter of weeks, investors would be foolish not to take some chips off of the table. Asset Managers are not going to chase stocks when they are trading at the top of their range before major news events. That means the bid to the market will temporarily fade.

As I have been suggesting for the last two weeks, take profits. If you are a very short-term trader and your eyes are glued to the screen, you can try to play the downside. That is a risky proposition since the upward momentum is strong. At any moment, buyers could step in and slam the door in your face. I prefer to stay in cash and watch from the sidelines.

I only have 10% of my longs left and I plan to be out of them tomorrow. It has been a great run and I'm happy to lock-in profits after stumbling early in September. Any substantial decline will represent a buying opportunity once support is established.

Look for choppy price action today with a negative bias. If we make a new low in the afternoon, we could drift down to SPY 117. I don't see us going much below that level today. Nervousness could spill over to tomorrow and at worst; the market will test SPY 116 this week. Take profits and exit long positions.

Daily Bulletin Continues...