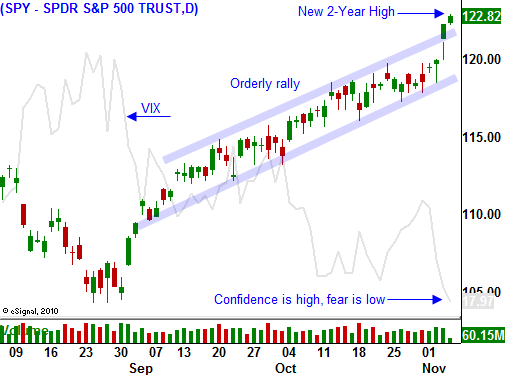

The Market Is Making A New 2-Year High! Stocks Will Grind Higher.

This week, the market has benefited from a multitude of news releases. It is currently making a new two-year high and confidence has returned.

As expected, Republicans scored big during this week's elections. They gained control of the House and they picked up seats in the Senate. Yesterday, the president said that he might consider extending the Bush tax cuts for all Americans. The market loved this news and stocks shot higher. Both parties will need to compromise to get this economy back on track and this is a step in the right direction.

The Fed outlined a $500 billion round of quantitative easing that will be spread out over a six-month period. This news was expected by traders and it was in line with expectations.

On the economic front, all of the news has been excellent. China's PMI climbed to 54.7, ISM services/manufacturing came in better than expected and 151,000 jobs were created in October. Employment is the key to this economic recovery and corporations are starting to expand payrolls.

Earnings have been excellent and 70% of the S&P 500 has posted results. Almost 85% of the companies have exceeded earnings estimates.

On a valuation basis, stocks are cheap. Money has been flowing into bonds for many months and that flight the safety could soon reverse. The market is making a new two-year high and that will attract investors. Assets will rotate out of fixed income and into equities.

The threat of a credit crisis has temporarily subsided. In today's chart you can see that the VIX has fallen dramatically. Fear is getting squeezed out of the market and option premiums are declining.

Under allocated Asset Managers are the only ones running scared. They have waited patiently for a pullback and they haven't gotten one. Now they will have to chase stocks or risk missing a year-end rally.

There are major cracks in the foundation, but this house of cards will stand through 2010. Start scaling back into call positions and focus on stocks that are strong relative to the market. These companies have already broken out on high volume and they continue to march higher.

The momentum points higher and now that major news events are behind us, there is nothing to stand in the way of this breakout. Look for an orderly rally to continue next week.

Daily Bulletin Continues...