China’s Tightening Was Expected. This Is A Nice Opportunity To Get Long!

The price action this week has been choppy and it's nice to see some two-sided movement. Early in the week, fears of an Irish credit crisis and the potential for a Chinese interest rate hike spooked the market.

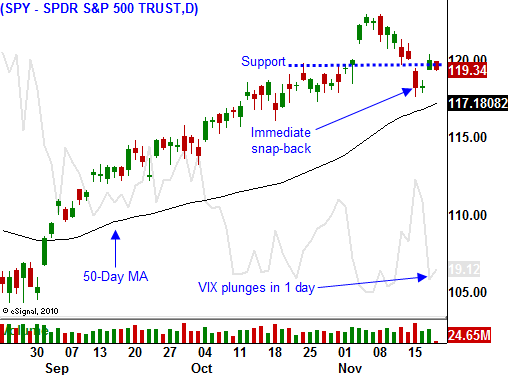

Stocks pulled back sharply and they broke below key support at SPY 120. Those losses were erased yesterday and traders are confident that the EU/IMF will provide aid to Irish banks. The Irish government did not want a loan because their fiscal spending would come under scrutiny. The EU Finance Ministry does not want this problem to fester and is likely they will find a solution in the next few days.

Overnight, China did raise its bank reserve requirements by 50 basis points. Banks now need to hold 18.5% in reserve. The good news is that they did not hike interest rates. Even though the market does not like the news, I see this as a positive. China's economy is so strong that they are trying to put brakes on. The initial negative reaction this morning will soon dissipate. The move was largely expected and it was not as "hawkish" as a rate hike.

The economic news has been excellent the last few weeks. Private sector job growth is improving, initial jobless claims are slowing down, ISM manufacturing and ISM services have been good, retail sales increased more than expected, inflation is tame and yesterday's Philly Fed was strong.

Next week, the trading will be light since the week is split up by Thanksgiving. The price action tends to be positive during this holiday. Retailers have been posting decent numbers and the retail sales number this week was good. That should provide a bullish backdrop heading into "Black Friday" next week.

The economic releases include GDP, personal income, durable goods, initial claims, consumer sentiment and the minutes from the FOMC meeting. The last item is perhaps the most significant since we might gain insight on the quantitative easing sentiment inside the Fed.

The strong rally we have seen since September should continue into year end. Credit concerns will keep the market from getting ahead of itself and we can expect a nice orderly rally. Earnings have been excellent, inflation is low, China's growth is intact, stock valuations are attractive, economic conditions have been improving and this is a seasonally bullish time of the year. The market barely declined and buyers quickly stepped in before support was tested. That is a sign that Asset Managers are anxious to get in.

As I've been mentioning, any decline would be short-lived. Today's decline is an opportunity to get long. I am selling out of the money put credit spreads on stocks that generate overseas revenues. Option premiums have declined and I am also buying a few at the money calls. I don’t want to get overly bullish and that is why I am favoring selling strategies. I want to distance myself from the action and give myself some breathing room.

Look for quiet trading next week with an upward bias. The credit issues in Europe will continue to build, but they will not come into play this year. Don't go overboard with bullish positions, but take advantage of this pullback.

Daily Bulletin Continues...