Interest Rate Spikes In Europe Very Concerning. Selling Pressure Is Mounting!

Yesterday, the market spent most of the day in negative territory. Credit concerns in Europe continue to build even though Ireland has been bailed out.

Seasonal strength attracted buyers and the market finished in positive territory. Corporate profits have been incredible, balance sheets are strong, interest rates are low, and economic conditions are gradually improving. This morning, Chicago PMI came out much better than expected. Overnight, China will release its PMI and most analysts are expecting a strong number near 54.8. Tomorrow's ADP index and ISM manufacturing should also be "market friendly".

I've been mentioning for a few months that the inventory cycle has run its course. Economic growth will be completely determined by new demand for goods and services. Economists had expected slower growth in the second half of 2011 as the inventory rebuild wore off and as stimulus packages end. Growth in the Philippines, Thailand and Singapore contracted last quarter while South Korea, Taiwan and Indonesia showed significant declines. This time table is earlier than expected and it needs to be monitored closely.

The credit crisis in 2009 spread quickly throughout the financial sector. Once the panic started, even strong banks were on the brink of disaster. Excess liquidity lead to poor lending decisions and the entire system was overleveraged. The problem was resolved with more leverage.

Governments printed money to bail out financial institutions. Unfortunately, many nations have been running deficits for decades and they have structural debt problems. The credit crisis of 2009 is simply shifted from financial institutions to governments. Sovereign debt will be a lingering issue and it will result in a global crisis.

Europe, the United States and Japan (75% of the world's GDP) have massive debt levels. We can no longer balance our budgets and each year we will sink further and further into debt. The rate at which we are sinking has grown exponentially. At the turn of the millennium, our nation was $2 trillion in debt. A decade later, our national debt has skyrocketed to $14 trillion. The Congressional Budget Office projects that we will run deficits in excess of $1 trillion each year for the next 10 years (not including a "self funding" national healthcare program). It is a very conservative number and the shortfall will be much greater.

Our country has only run a budget surplus four years out of the last four decades. The greatest surplus was $225 billion (chump change) in 1999. We are not going to work our way out of this mess. It is nice to save $5 billion per year by freezing government wages, but that is hardly the solution. Cutting waste is also important, but it won’t solve the problem. We are bailing water out of the boat when we need to focus on fixing the leak (Social Security, Medicare, Medicaid and Pensions).

Once investors fear default, they stop lending money. Interest rates start to climb as risk gets priced in. Borrowers find it difficult to raise capital and they can no longer meet their obligations. At this juncture, investors start to sell their holdings and a liquidity squeeze emerges. They will sell anything of value to raise cash.

This financial crisis will make 2009 look like a cakewalk. We are not talking about a corporation failing; we are talking about an entire nation(s). Governments, financial institutions, mutual funds and pension funds all have exposure to sovereign debt and every investor will be affected.

The cracks in the dam this summer (PIIGS) were temporarily patched by the ECB/IMF. They purchased sovereign debt to ease fear and they masked the problem by propping up the demand in PIIGS bond auctions. They also conducted a banking stress test that turned out to be a giant PR campaign. The “test” assumed that there would not be any sovereign defaults so the banks all passed with flying colors. These efforts worked temporarily, but now market forces will reveal the magnitude of the problem.

Last week, Germany was trying to change the bailout parameters. They wanted investors to take a write down on Irish loans before aid was granted. That would give aid dollars higher standing since losses would be established. The EU/IMF did not force any “haircuts”. If they did, we would get a glimpse of the risk exposure. This might have sparked a run on those banks and the EU/IMF wanted to avoid that.

Retirement programs and health care are bleeding countries dry. Aging demographics will compound the problem in coming years. Citizens are rioting at the mere hint of reform. Proposals to roll back the retirement age over many decades are being shot down and politicians don't want to anger their constituents.

We know that interest rates in Ireland continue to move higher even after the aid package was delivered. Now the focus has shifted to Portugal and Spain. During the last month, rates in those countries have jumped higher. In fact, Spain's interest rates on 90-day bills doubled in three weeks. Short-term rates hardly ever move and it's hard for me to describe the magnitude of this event. Now, rates in Italy have started to move higher. Their national debt alone equals 25% of the EU's GDP. I'm also hearing that Belgium is in dire straits and it can be added to the long list of potential defaults (Greece, Ireland, Portugal, Spain, Italy, Belgium, Hungary, Romania, Bulgaria, and Latvia).

The US is living off of its reputation and that "flight to safety" is keeping us afloat. The world's reserve currency is not on sound footing and this apple could rot from the inside out. States are running huge deficits and they are also plagued by structural debt problems. From 2000 – 2004 (the tech bubble), all 50 states grew debt by $250 billion. In just 18 months, those same 50 states have amassed $350 billion in debt. Muni bond interest rates are starting to climb and borrowing costs for state and local governments are on the rise as risk gets priced in.

Last summer, investors flocked to US treasuries when problems in Greece flared up. Now the problem is even bigger and we are not seeing that same pattern. With the Fed buying US treasuries, you would expect money to flow into our bonds. It is possible that the safety of US debt is being reevaluated. That is a giant warning sign.

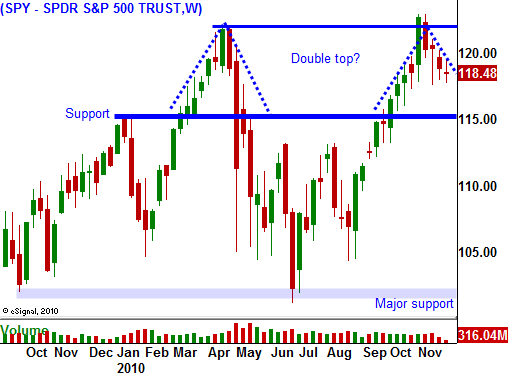

When I look at the mounting pressure this week, I am starting to change my bias. The market has had to fight to tread water and during a seasonally strong period for stocks and it should not have to. The economic releases this week should help us keep our head above water, but the selling pressure is growing.

I fear that we are preparing for a big decline and that the crisis might finally be at our doorstep. The problems in Europe are too great to resolve and the EU is too fragmented to act decisively. Each day there will be new fires to put out and they will spread from country to country until they are out of control.

Gold is not a safe haven. It is an asset and once the liquidity squeeze is on, investors will sell anything of value. The only way to protect your capital is to short stocks. Buy puts on companies that need financing to survive. Once credit dries up, they will struggle to survive.

For those who might think I enjoy writing about gloom and doom, I do not. I have NOT been writing about the demise of financial markets for decades. My concerns 3 years ago prompted me to conduct extensive research and I was alarmed by what I learned.

The next month should give you time to adjust your investments. Get liquid and be prepared to buy puts on a technical breakdown. Go way out in time (6 months +) and go way out of the money 20-30%.

I did sell some put credit spreads yesterday, but I am starting to buy back all of my put credit spreads. I will make a little money at this juncture, but I prefer to sit on the sidelines. The storm clouds are building and each subsequent storm will grow in intensity.

Daily Bulletin Continues...