Seasonal Strength, Buy Programs and Friendly Economic Releases Will Push Stocks Higher

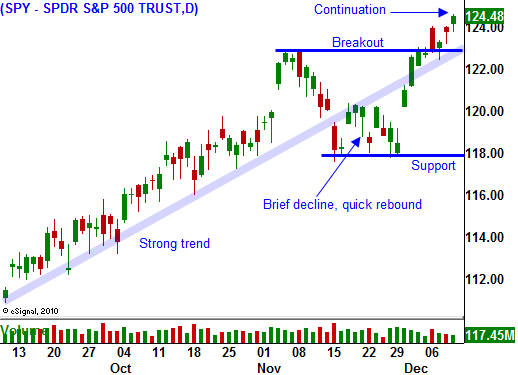

This morning, the market continues to push higher after breaking out above major resistance last week. Strength in Asia provided a springboard and stocks are making a new two-year high.

Inflation in China hit 5.1% and that was slightly "hotter" than expected. Last week, they raised bank reserve requirements and they continue to tighten money supply. Many analysts had expected them to raise rates and this was a more "dovish" course of action. The news on both fronts could have been much worse and investors are embracing the outcomes.

Economic releases this week should be "market friendly". The CPI and PPI have not spoiled this rally and they are likely to be benign. Retail sales have been excellent and Black Friday/Cyber Monday sales were excellent. Consumer confidence has been improving and that also bodes well for tomorrow's retail sales number. Initial claims improved last week and the four-week moving average is moving declining. This number should also support the market rally. Empire Manufacturing, industrial production, housing starts, the Philly Fed and LEI have not moved the market much in recent months.

The FOMC meets this week and it should be a non-event. After Bernanke’s 60-Minutes interview a week ago, the market knows where the Fed stands.

Trading volumes will decrease heading into the holiday and even a small bid can prop up prices. The ECB will be buying sovereign debt and interest rates will stabilize over the next few weeks. That will ease Euro credit concerns and pave the way for the year-end rally.

Seasonal strength will push stocks to new highs. Option expiration will also provide upward action as buy programs kick in this week. I am not expecting a blow off rally, just nice steady advancement.

Commodity producers, heavy equipment manufacturers, tech and retail have performed well. Focus on stocks that have posted nice year-to-date gains and have a defined support level. Asset Managers will be "window dressing" over the next few weeks and they will want to appear as if they had been long the best performers. They will be buying these stocks over the next few weeks.

I have longer-term concerns so I am limiting my risk exposure. Interest rates in Germany and the US have started to climb and I believe risk is getting priced into our bonds. Germany is backstopping PIIGS debt and it is jeopardizing its own balance sheet in the process. As inconceivable as this might seem, investors are not fully sponsoring US bond auctions and the demand has fallen off. As long as we continue to spend money hand over fist, we can expect yields to move higher. Higher interest rates will provide a headwind for stocks.

I am buying calls. Option premiums are low and this strategy allows me to participate in the upside while limiting my risk. I am buying in the money options that will move point for point with the underlying stock. I am expecting a gradual grind higher and buying in the money options allows me to take profits along the way.

Embrace this rally and limit your risk. Credit concerns will not be an issue over the next few weeks.

Daily Bulletin Continues...