Financial Institutions and Hedge Funds Love To Bid Up Stocks Into Year End!

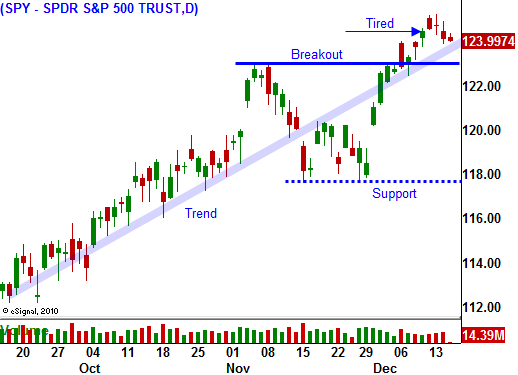

The market continues to search for a catalyst. After a 20% run-up in three months, stocks are tired.

The economic news this week has been positive. Inflation is relatively contained and producers are not able to pass higher costs on to consumers. Retail sales are robust and manufacturing is stable. Initial jobless claims decreased by 3,000 this week and that was better than expected. Most importantly, the four-week moving average continues to decline.

Interest rates in Europe are creeping higher. Portugal held a bond auction Tuesday and the demand was fair. Their short-term rates have doubled in the last month and that is a sign of trouble. Overnight, Spain auctioned €2.3 billion in bonds. The maturities varied and relative to auctions a month ago, rates jumped 80 to140 basis points. European officials are meeting in Brussels to discuss the credit crisis and the ECB wants member nations to pony up more bailout money.

The ECB has been busy buying PIIGS debt. Even with that support, rates are still climbing.

The Bush tax credits have been extended and you would expect to see more of a celebration. This is a mixed blessing since it will stimulate the economy and increase deficits.

Durable goods orders and GDP are not likely to move the market much next week. Trading volumes will decline ahead of the holiday and that bodes well for bulls. Financial institutions, hedge funds and money managers love to bid up stocks into year end. Even a small bid in light trading can push stocks higher. As a result, performance is boosted and bonuses increase.

After a negative open, stocks have regained momentum and the market looks good. Prices should continue to grind higher. I still like commodity stocks and I am long calls. As 2011 approaches, I will scale out of positions and move to cash.

I don't like what I'm seeing in Europe and the New Year could greet us with a slap in the face. I will keep an eye on European interest rates and we will be ready to take action when support fails.

Daily Bulletin Continues...