Light Holiday Trading Favors the Bulls. Stocks Will Inch Higher.

The market is stuck in a very tight trading range and it is looking for its next catalyst. Republicans and Democrats agreed to extend tax credits and unemployment benefits last week. On a short-term basis that is bullish and it should spark buying.

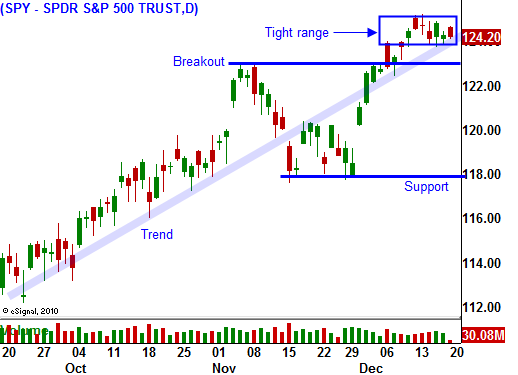

Seasonal strength, option expiration and a decent round of economic news did not propel stocks to a new two-year high. The market has been able to hold the breakout, but it has not been able to advance.

The economic news this week will be decent. GDP, durable goods orders, initial claims and consumer sentiment should all be "market friendly". These are not typically market driving releases and the action will be light in a holiday shortened week.

Institutions like to bid up stocks ahead of year-end. This improves performance and a strong finish improves investor confidence. Hedge funds also collect larger bonuses. A small bid in a quiet market can push a stock higher even if only a handful of shares are traded.

As we head into 2011, the credit concerns will heat up. In the US, we continue to increase deficit spending without any regard for our national debt. Even a small uptick in interest rates will have a devastating impact on our budget. States are in a similar situation. Meredith Whitney was featured in a 60 Minutes segment last night called "State Budgets: The Day of Reckoning". I suggest you watch it.

The ECB is trying to secure additional capital from EU members for its bailout slush fund. Each country has its own balance sheet and political opinion. It will be very difficult for the EU to enforce spending policies. This needed to be outlined when the EU was formed.

Changes to retirement benefits and healthcare won't be addressed in Europe or the United States until it is too late. Politicians know that cuts to these programs will cause rioting and it will end their careers. As voters, we elect candidates the represented pleasure, not pain. Consequently, we will spend our way into collapse.

In 2011, credit concerns will come to life. It's important not to short the market prematurely. The warning signs will be obvious and a technical breakdown will tell us when to take action.

I am long deep in the money calls and these positions are working out well. My positions are small and I don’t want to stick my neck out too far. I have trailing stops in place. Next week, I will start setting targets and scaling out of my positions. By year-end I will be flat.

Daily Bulletin Continues...