Set Targets and Scale Out Of Long Call Positions The Next 2 Weeks.

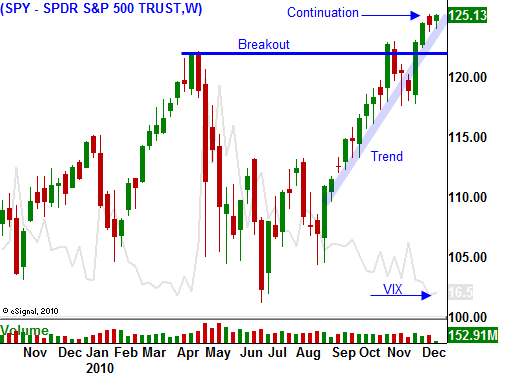

As expected, the market continues to grind higher. It has been able to hold the breakout and add to gains. Advancers outnumber decliners by 2 to 1 and the market is making a new two-year high.

Asset Managers are buying stocks into year end. They are able to “goose” the market in light trading and that boosts performance. It also makes people feel good when they look at their year-end statement. Confidence is running high and the VIX is dropping.

Bears know not to stand in front of seasonal strength. They will let this momentum pass and they will look for an entry point when the rally stalls. If not for the threat of a financial crisis, stocks would be off to the races.

Overnight, Spain held its last bond auction of the year. It sold €3.9 billion of three and six month bills. The demand was decent (partly because the ECB is buying sovereign debt) and yields inched higher. The debt crisis in Europe will reignite early in 2011.

Credit concerns in the US will also surface in it will start with state budgets. They are $350 billion in debt and they project another $150 billion in deficits this year. Like our nation, states are strapped with huge pension and healthcare expenses. A year ago, professors Robert Novy-Marx (University of Chicago) and Joshua D. Rauh (Northwestern's Kellogg School of Management) estimated unfunded pension liabilities of $3.2 trillion for the 50 states. We are seeing municipal bond yields jump as the risk of default increases.

Last Sunday on 60 Minutes, Meredith Whitney (one of the sharpest minds on Wall Street) said that the state credit crisis would erupt before the end of 2011. Her team of analysts has gathered information during the last two years in an attempt to evaluate municipal bond ratings. After thousands of man-hours she concluded that this will be our next credit crisis.

The economic news this week should not spoil the rally. GDP estimates have been improving and the four-week moving average for initial jobless claims has been declining. Durable goods orders are volatile and the market typically dismisses the news good or bad.

As long as the market keeps grinding higher each day, it's easy to hang on to deep in the money call positions. The options are moving point for point with the underlying stock. Start taking profits when the momentum slow and keep your risk exposure is small. This move is taking place on light volume and one bad news event can quickly wipe out profits. Exit some of the positions Thursday and scale out the remaining positions next week.

Try to be flat heading into 2011. Interest rates in the US and Europe are rising because of risk. Politicians are unwilling to reform retirement benefits and health care. Debt is spiraling out of control and much of it has been financed with short-term bonds. Rising interest rates will dramatically increase expenses.

In 1982, interest rates spiked to 15%. At that rate, we would not be able to pay the interest on our $15 trillion debt. Our nation's total revenue is somewhere around $2.3 trillion. Our interest payments would be roughly the same. That means we would not have money for anything else (Social Security, Medicare, Medicaid, defense, education, homeland security, transportation...).

It's not likely that interest rates will hit that point unless panic sets in. I'm just trying to illustrate how dangerous the problem is and the magnitude of $15 trillion. Even if 10-year rates rise to 7%, we are in deep trouble.

Enjoy this rally and ride it as long a possible. When the tide turns, things could get very ugly.

Daily Bulletin Continues...