Watch For Santa Claus Next Week. Profit Taking Would Not Be A Good Sign For 2011.

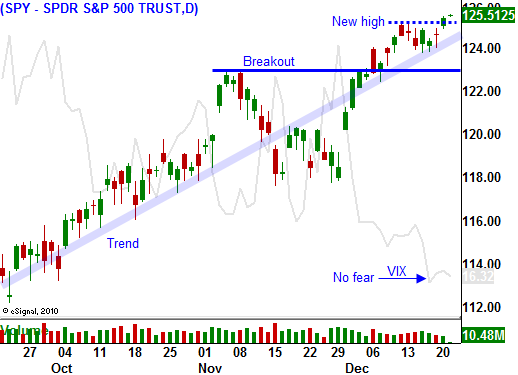

Seasonal strength is pushing the market to new highs. Asset Managers bid stocks up into year end and nice gains take place on light volume. This "gooses" performance and investors feel good when they open their quarterly statements at the end of the year. This is such a powerful force that traders rarely stand in front of it.

In a Reuter’s poll of 13 fund management companies, equity allocations rose for the fourth consecutive month. From December 10-21, funds increased their stock holdings by 2% on average and they have two thirds of their money dedicated to equities. This is close to the high of the year (66.2%) last February.

Stocks are cheap relative to bonds. Many dividend yields exceed the returns of a 10-year bond. Investors generate income and they have the potential for capital appreciation. I expect to see this rotation continue.

The economic news this week is light. Today, Q3 GDP was unchanged at 2.6% and it had little impact on the market. Tomorrow, durable goods orders will be released. They are extremely volatile and if the number comes out "soft", it should not spoil the rally. Initial jobless claims have been dropping and the four-week moving average is moving lower. This trend should continue and initial jobless claims will be more important than durable goods orders on Thursday. After the first hour of trading, activity will drop off dramatically.

I have mentioned seasonal strength. Next week, we will see if the Santa Claus rally pushes stocks even higher. This anomaly is so powerful that when it fails to happen it signals trouble. Traders would normally want to "ride the wave" into year-end knowing that their bullish positions still have room to run. When they get nervous and start taking profits the momentum stalls and stocks reverse quickly. This is exactly what happened in December 2007. Stocks declined in the last few days of trading, but the market did not roll over for a few more months. When it did, it fell hard.

I will be watching the price action next week. Rising interest rates in Europe make me nervous and I will start scaling out of my bullish positions tomorrow. I have nice profits in my deep in the money calls and I don’t want to be greedy.

I am very concerned that 2011 will mark the beginning of a global credit crisis. Timing that decline will be critical. The market could surprise all of us and stage a nice rally before it falls apart. I will be trying to hit singles on the way up and my finger will always be on the "sell button".

I don't mind missing some upside, but I don't want to have the rug pulled out from under me. I also don't want to be early shorting this market. Every day it moves higher, my shorts cost me less and if I were in bearish trades, I'd be losing money. Traders that bought puts ahead of the "tech bubble" or the "housing bubble" were carried out in body bags before the market rolled over. Timing is everything.

Hit singles on the way up and be ready for a sharp decline. That is the theme for 2011.

Daily Bulletin Continues...