Will Santa Clause Visit Wall Street Next Week?

Merry Christmas and Happy Hanukkah!

This morning, initial jobless claims came in flat, durable goods orders were slightly better than expected and consumer spending rose for the fifth straight month. The economic news was decent, but it has not moved the market.

Trading activity will evaporate shortly after the open today. The economic news next week (consumer confidence, initial claims, and Chicago PMI) is very light and that favors the bulls.

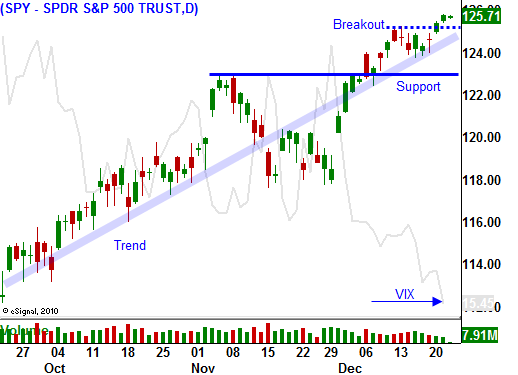

Stocks are making new two-year highs and the momentum is strong. At year-end, Asset Managers "goose" the market to enhance performance. In light volume conditions a small bid can push stocks higher. Traders don't want to bet against "size" and stocks rally on little or no volume.

This activity explains the "Santa Claus Rally". We can expect the same type of pattern we've seen this week to continue. When stocks don't move higher after Christmas, it is a warning sign. Traders who would normally milk additional profits out of their positions decide to take profits early. That selling pressure can catch on and stocks reverse.

In 2007, Santa Claus did not visit Wall Street and stocks declined during the last few days in December. It took a number of weeks before the market peak was reached, but stocks eventually tumbled.

I will be monitoring the price action very closely next week. Credit conditions in Europe are deteriorating quickly and I believe they will come to a head early in 2011. Overnight, Fitch lowered Hungary's debt rating to BBB-. They repealed pension reforms and that shows a lack of fiscal responsibility. Interest rates throughout Europe are climbing quickly as risk increases.

The third-year of a presidential term is typically bullish. That along with strong momentum, solid earnings, low interest rates, improving economic conditions, low taxes and QE2 should provide a good start to the year. When the market does top out, it will present an excellent shorting opportunity.

We are long deep in the money calls and you should scale out of your positions over the next week. By the end of the year, you should try to be in cash. My longer-term bias is very bearish. That means we will be trying to hit singles during the last stages of this rally. We will keep our size small and we will take profits quickly. When the big hurt finally comes, we will be ready to strike.

There won't be much action the next two weeks. Spend time with your friends and family and get ready for a VERY busy year.

May you and your family find peace and happiness this holiday season.

Daily Bulletin Continues...