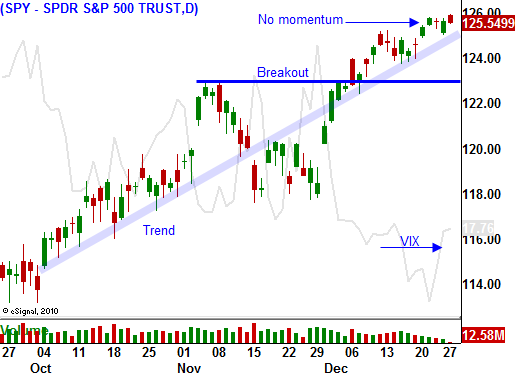

Momentum Is Slowing Down. Take Profits On Long Positions This Week.

Yesterday, the market started off the week on a very quiet note. Holiday vacations and heavy snowfall on the East Coast kept traders at home. The momentum from this rally has slowed and prices have not moved much in the last week.

Over the weekend, China raised interest rates by .25%. This news was highly anticipated and after a small decline, the market gradually recovered throughout the trading day Monday. China has steadily increased bank reserve requirements and that has not sufficiently slowed growth. They are cautiously applying the brakes and a rate hike was the next logical step. Rising interest rates are bullish when they result from economic growth. This is not the case in Europe.

Structural debt problems need to be addressed and the risk of a sovereign default continues to grow. Pension benefits and healthcare are draining reserves at an alarming rate as workers retire. Tiny austerity programs won't make a dent in the deficits. Investors are nervous and they are not buying sovereign debt at these prices.

The ECB has been buying PIIGS debt to artificially suppress interest rates. Last week, they doubled their purchases from the prior week to support bond auctions. They spent €1.1 billion compared to €603 million the week before. The ECB is trying to raise more money from its members and it knows the problem will escalate quickly if Spain and Italy join the party. Interest rates throughout Europe are rising do to risk.

The same problem exists in the US. Politicians agreed to keep taxes low and to increase spending. Our deficits will grow and the bond market is nervous. Rates here are rising here as well. Municipal bond yields have jumped and investors fear state and local defaults.

The credit problem will continue to grow in 2011. Tomorrow night, I will be hosting a free webinar at 9 PM ET. I have been collecting information during the last few months and I want to prepare you for the upcoming credit crisis. To register CLICK HERE.

It is important not to jump the gun. This rally could continue and you will sustain huge losses before the market finally rolls over.

Retail sales jumped 4.8% the week before Christmas and that was at the high end of estimates. Initial jobless claims have been declining and that is a positive sign for employment. Balance sheets are strong, profits are robust, interest rates are low, tax credits have been extended and the Fed is printing money. These are all very powerful influences.

I am scaling out of my long positions. By the end of the week, I plan to be in cash. From this point on, I will try to hit singles when I play the upside. I want to buy dips and I will sell into strength. We are in the final inning of this rally and I want to limit my risk exposure.

Playing the upside in this manner serves two purposes. It provides me with an opportunity to make a little money and it prevents me from prematurely loading up on puts. I need to keep my positions small. The IVs are low and I am buying in the money calls. The momentum is slowing down so I need to make sure that I can take profits along the way. These options move with the stock. Out of the money options are ideal for explosive moves and we are not in that environment.

Look for strength this week. The economic news is very light and stocks should inch higher.

Daily Bulletin Continues...