Santa Claus Visited Wall Street. Take Profits On Longs This Week.

Santa Claus is coming to town. The last trading week of the year is typically bullish and this anomaly is called "The Santa Claus Rally". The momentum is usually strong heading into year end and Asset Managers bid up the market. On very light volume, stocks creep higher.

Traders will not stand in the way of this move and they lift their offers. It is almost as if stocks defy gravity and they float higher. This environment serves a purpose. When investors open their fourth quarter statements, they are pleasantly surprised. They have confidence and they plow retirement money into equities at the beginning of the year. Hedge funds also benefit. When new high water marks are reached, bonuses expand.

On occasion, traders use this strength to unwind long positions. That selling can catch on and profit-taking sets in. A decline in the last week of trading signals trouble ahead. I don't see any signs of that happening this year.

As January goes, so goes the year. This indicator has a 91% accuracy rate in the last 60 years. The third-year of a presidential term is also bullish and it appears that both parties are willing to compromise.

If not for massive debt levels, the market would be off to the races. Earnings, interest rates, economic activity, quantitative easing and taxation are all "market friendly". Unfortunately, the foundation is cracked and this castle is ready to crumble.

When a heroin addict wakes up, it's a good day. It means that they haven't killed themselves and they get busy lining up their next fix. After they shoot up, life is grand again. They live day-to-day and they don't worry about tomorrow. Kicking the addiction would be very painful and they promise to stop - tomorrow.

Americans are addicted to credit. Over 70% of our economy is based on consumption. As a country, we produce very little (manufacturing is 20% of our economy) and we rely heavily on imports. We used to finance our own habit, but now foreigners hold more than half of our debt. We elect enablers and politicians make this lifestyle possible.

Right now, we are "high" and life is grand. In the absence of a credit default, the market will continue to push higher. In the early stages of a credit crisis, the EU will pull out all of the stops to keep it from spreading. The ECB/IMF/Fed will be scrambling to "hook us up" and their actions will be “unprecedented”. You might remember that phrase from the spring of 2009 when the Fed through the kitchen sink at the credit crisis. We will see declines and snap back rallies. Eventually, the bottom will fall out and that's when it gets scary.

I don't know when this flashpoint will be reached, but I would be shocked if we make it through 2012.

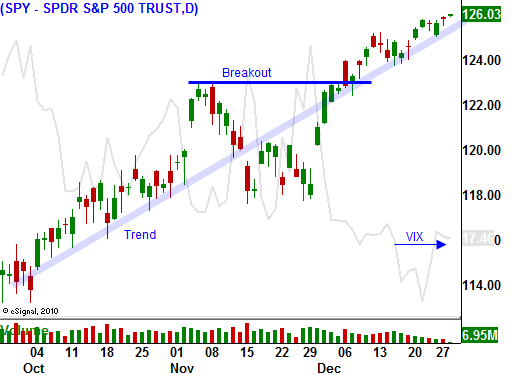

We've been long in the money calls in commodity stocks and heavy equipment manufacturers into year end. Those positions are up very nicely. I still like the stocks, but I don't want to be greedy. I am taking profits this week with the goal of being in cash by the end of the week. I will start 2011 with a clean slate and I suggest you do the same.

Daily Bulletin Continues...