Euro Bond Auctions Should Be Decent – Stocks Will Creep Higher Late In the Week

Last week, the market rallied strongly after a much better than expected ADP number. It processes payrolls for small to medium-sized businesses and it estimated 300,000 new jobs were added to the private sector in December. This was the highest reading it has ever recorded and it blew away analysts estimates (100,000 new jobs). Other economic numbers (Chicago PMI, factory orders, ISM manufacturing and ISM services) have also been pointing to improved activity. The market was expecting an excellent Unemployment Report Friday and estimates were pushed up after the ADP number.

Bulls were splashed with cold water Friday morning when the December jobs number was released. Consensus estimates were for 175,000 new jobs and only 103,000 new jobs were created. Employment for October and November was revised to reflect 70,000 more jobs than initially reported. The expectations were too optimistic and the market pulled back. That selling pressure continues to weigh on the market this morning.

Credit concerns in Europe are elevated. Greek bond yields are rising on the eve of their auction. Portugal will auction bonds on Wednesday and Spain and Italy will auction bonds on Thursday. The ECB has money in its coffers and it will aggressively support these auctions this week. China has also stated that it will support Spain's auction. This early round of financing in 2011 should go fairly well. I am not expecting fantastic results, but they should be good enough to calm nerves. Every day that the credit crisis is avoided, the chances for a nice rally increase.

After the close, Alcoa will release its earnings. That marks the beginning of Q4 and the first two weeks are typically bullish. Some of the strongest companies post their numbers at the beginning earnings season. Intel will announce after the close Thursday and it will set the tone for tech stocks. It has pulled back to the middle of its three-month range and it has room to run on both sides. On Friday, J.P. Morgan Chase will release results. The stock has broken out above major resistance at $42 and the financial sector has performed well recently. The economy has been improving and that should reduce write-downs. I believe this stock has upside and it is one of the strongest banks in the country. The major earnings news won't hit for another week. Stocks should creep higher Thursday and Friday.

The economic news is rather light this week. We will get a read on inflation when the PPI and CPI are released. I am expecting higher wholesale prices and flat consumer prices. Companies have not been able to pass higher costs onto consumers and the releases should not have a major impact on the market. However, profit margins could be impacted this earnings season.

There is no doubt that a credit crisis looms. I believe it will start in Europe, but situation is just as dire in the US. In my home state of Illinois, personal income taxes will increase by 75% from 3% to 5.25%. This will bite into discretionary spending as a host of other states follow suit. They are running huge deficits and the need to balance budgets.

A credit crisis can unfold in a matter of days and I will be ready to exit positions at the first sign of trouble. I believe that there is enough money to support the first round of Euro bond auctions this year and that will pave the way for a nice rally. Earnings should be excellent and economic conditions have been improving. I am selling out of the money put credit spreads in January on strong stocks. These positions will inspire before earnings announcements.

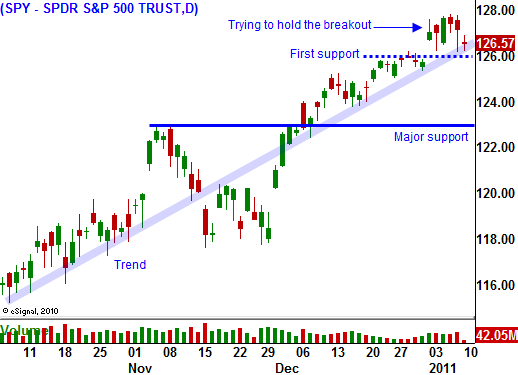

My crystal ball is very foggy beyond January. I will need to gauge interest rates in Europe, our municipal bond market and earnings reactions before I can make a forecast for February. Cautiously trade the upside for the next two weeks. A breakdown below SPY 123 would be bearish and you should use that as a stop.

Daily Bulletin Continues...