Banks Are The Key To The Next Leg Higher – Watch JPM Tomorrow!

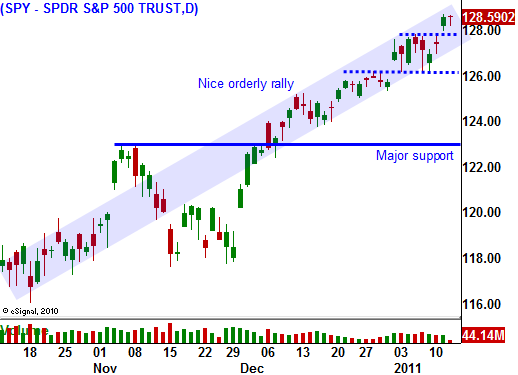

The market has been grinding higher for weeks and is at a new two-year high. Bullish conditions are keeping buyers engaged while the threat of a credit crisis contains the level of excitement.

Strong ISM manufacturing/services numbers and a gang buster ADP report sparked a nice rally last week. High expectations for Friday's Unemployment Report were dashed when only 103,000 new jobs were created in December. The market pulled back slightly and it braced itself for European bond auctions this week.

The ECB/IMF has plenty of money in its coffers and there was little doubt they would put it to use. They have aggressively supported the auctions held by Greece, Portugal, Spain and Italy. China stated publicly that it will support Spain's bond auctions and they have gone fairly well. With credit concerns pushed to the sidelines, the market can focus on earnings.

After the close today, Intel will post results. The stock has moved into the middle of its quarterly range and it has room to run on both sides. Their guidance will set the tone for tech stocks. Before the open tomorrow, J.P. Morgan Chase will announce earnings. Economic conditions have been improving and write-downs should decline. This is the strongest bank in the nation and I am expecting good results.

The biggest and strongest companies tend to release earnings early in the cycle and that is why the first few weeks of the season are typically bullish. Next week, large banks like Wells Fargo and Bank of America will post results. Investment banks like Goldman Sachs and Morgan Stanley will also release earnings. Financial stocks have gradually been moving higher and the entire sector looks poised to rally. Tech stocks like IBM and Google will also be in the spotlight.

The economic news will be fairly light and it will not disrupt what should be a bullish week. This morning, initial jobless claims spiked more than expected, but the increase was dismissed as a seasonal event. People typically postpone filing for unemployment during the holidays and this adjustment has run its course.

With the European bond auctions out of the way, traders will breathe easy for a few weeks and the market will be able to move higher. I am not expecting a massive move higher and resistance at SPY 130 formidable. We will see sector rotation out of consumer discretionary and into financials. In addition to technical resistance, there are a couple of other concerns.

Producer prices have been increasing and the PPI rose 1.1% in December. This trend has been in force for a few months, yet the CPI has not increased. This means producers have not been able to pass higher costs onto consumers and it will impact profit margins. By the third week of earnings season, I believe all of the good news will be priced in and the market will have difficulty advancing.

The US has its own credit crisis. States are running massive deficits and pensions are dragging them down. Arizona sold its state capitol to raise money and Illinois just increased personal income taxes by 65%. They are plagued by the same structural problems that we see throughout Europe.

I plan on riding this wave for two more weeks. The momentum is strong and I like commodity stocks. When I see the momentum stall, I will start selling out of the money call spreads on retail and restaurant stocks.

As I look through the Live Update table I see fantastic opportunities on both sides of the market and that tells me that volatility is about to rise. Given the cross currents, this has the potential to be one of the most exciting years of my trading career.

Daily Bulletin Continues...