JPM Trading Higher After Earnings. Financials Need To Lead

I am kicking off my biggest promotion of the year and I just recorded this VIDEO Subscribers can get all of my products and services for a year at a deeply discounted price. Click Here to sign up. This is the lowest price of the year and the special offer will end soon.

Yesterday, the market declined slightly and stocks traded lower the entire day. Traders were less than impressed with yesterday's initial jobless claims number and the increase was dismissed as a seasonal adjustment. Last Friday's wimpy Unemployment Report is still fresh in everyone's mind.

The market will have to shoulder a round of negative news today. Consumer prices jumped .5% in December largely due to higher food and energy costs. Retail sales rose .6%, and that was worse than expected.

China raised its bank reserve requirements by .5% for the fourth time in two months. It also raised interest rates by .25% last month. China is clearly trying to put the brakes on its economy.

On the earnings front, Intel posted a decent number yesterday after the close. The stock is trading lower on concerns that iPad sales will steal chip demand from notebooks (a market dominated by Intel). Intel is trading lower, but semiconductor stocks are firm. J.P. Morgan Chase beat earnings estimates, but a large portion of its profits came from loan loss reserves that it pulled back. The market had a lukewarm reaction to the number and the stock is unchanged.

Large financial institutions will release earnings next week and this sector has the potential to fuel a rally. Given the reception JPM's number, that may not happen. Next week, Wells Fargo, Goldman Sachs, Morgan Stanley and Bank of America release earnings. Financial stocks have lagged the market. They have room to run and they have recently been moving higher.

The economic news is fairly light next week and European bond auctions are behind us for a few weeks. That means the market will focus entirely on earnings. Economic activity is on the rise and consumer confidence has improved. That bodes well for Q4 earnings and I am expecting a positive reaction.

The credit crisis dam has many cracks in it and soon we will run out of fingers to plug the holes with. New Jersey just auctioned bonds and rates spiked. Municipal bond yields are jumping higher across the country and risk is rising as states run massive deficits. Arizona was so desperate that it sold the state capital. In Illinois, personal income taxes increased 65% and corporate taxes were increased 45%. The US has issues on a national, state and local level. The crisis doesn’t necessarily have to start in Europe.

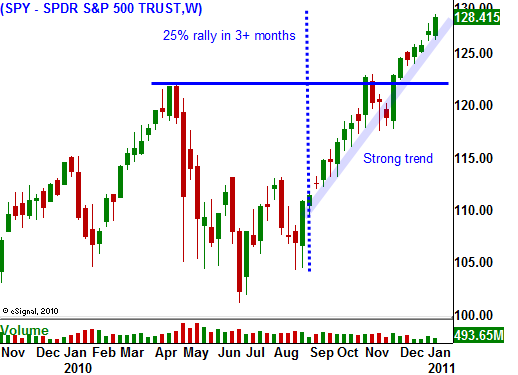

The next two weeks are seasonally bullish and the dark clouds hanging over this market will part temporarily. Stocks will move higher and I believe they will hit resistance at SPY 130. As we get further into earnings season all of the good news will be baked in and rising costs will hurt profit margins. The market will also start bracing itself for the next round of Euro bond auctions.

I have one foot on the gas and the other on the brake. I am long a handful of in the money calls and I am short put spreads. My risk exposure is limited to 30% of my portfolio. After next week, I will set price targets and take profits on my call positions. The put credit spreads are safely out of harm’s way and the short strikes are below major support levels. I plan to hold these positions as long as the SPY stays above 126. Get ready for a busy week.

Daily Bulletin Continues...