Enjoy The Party But Stand Close To the Exit. Stocks Should Move Higher Next Week

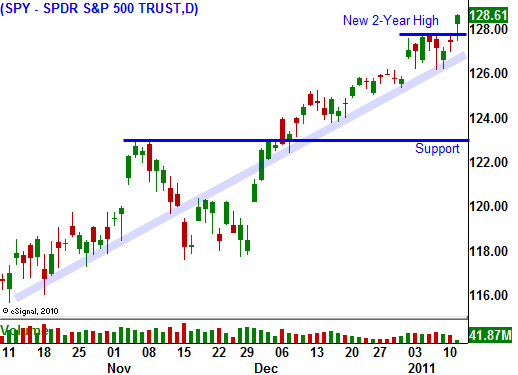

Earlier this week I suspected that the ECB/IMF and China/Japan would support Euro bond auctions this week and that would pave the way for a nice rally. Overnight, auction results were decent and PIIGS interest rates have declined slightly. The market is rallying and we are making fresh two-year highs.

As I have been saying, every day that we can postpone a credit crisis, the probability for a nice rally increases. Every other piece of the puzzle is in place for a liftoff. Corporate earnings are great, balance sheets are strong, interest rates are low, economic conditions are improving, the Fed is easing and taxes are low. Stocks have typically rallied into the first few weeks of earnings season and we have that impetus as well.

Financial stocks have been rallying and the entire sector was upgraded by a brokerage firm this morning. Economic conditions have been improving and write-downs should decline this quarter. Banks should have good Q4 earnings. This sector has lagged and it could fuel a rally next week. Big brokerage firms and banks will be releasing earnings. On Friday, we will get a preview of this sector when J.P. Morgan Chase announces results. It is one of the nation's strongest banks and I will be watching the price action very closely.

Thursday after the close, Intel will release earnings. Their guidance will set the tone for the entire tech sector.

I am hot under the collar this morning. In my home state of Illinois, personal taxes will go up from 3% to 5%. I would not mind paying higher taxes if the structural problems were addressed. Corporate taxes will be increased to 7% from 4.8%. Companies will leave the state and that will make the problem even worse as workers follow the jobs. Wisconsin and Indiana are already launching campaigns to lure corporations away. Exorbitant pensions are one of the root causes of our deficit. When I hear how much public sector retirees are collecting on an annual basis it makes me sick. I would leave the state, but that won't improve my situation. We will all end up paying for Illinois pensions because the nation will bail out fiscally irresponsible states. If it does not, a muni bond crisis will invoke a credit crisis in the US.

Illinois is a microcosm of what is happening in Europe. PIIGS are currently treading water with bail out money, but the problem has not been solved. Retirement benefits and healthcare benefits need to be slashed immediately or they will simply suck these countries right back into default in a year or two. On a macro scale, Social Security and Medicare/Medicaid are creating a debt spiral in the US.

For now, we won't concern ourselves with the worries of the world. We will enjoy the party and we'll drink some punch knowing that it is getting late and things are getting a little out of hand. We will stand by the exit so that we can leave quickly when the police show up.

I suggest just trying to hit singles in the final stages of this rally. You can sell out of the money put spreads or buy a handful of in the money calls on strong stocks. Place stop orders on all positions and try to take profits on the way up. Keep your positions small.

I believe we will grind higher next week. Commodity stocks are my favorite play.

In addition to technical support on the SPY, I am watching Spanish bond yields. When their 10-year yield goes over 6.5% (currently 5.5%), the party is over.

Daily Bulletin Continues...