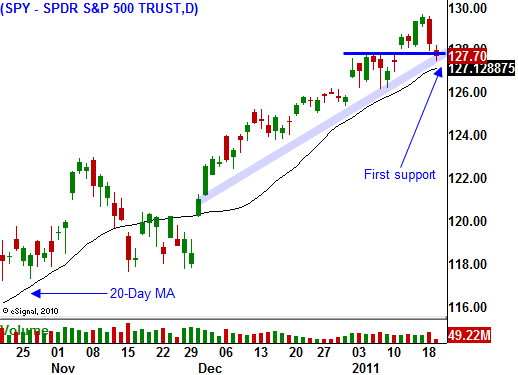

Profit Taking Has Set In. The Market Should Find Support At SPY 126.

My biggest promotion of the year has started and I just recorded this VIDEO Subscribers can get all of my products and services for a year at a deeply discounted price. Click Here to sign up. This is the lowest price of the year and the special offer will end soon.

Yesterday, stocks staged their first meaningful decline since November. Once the downward momentum was established, buyers pulled their bids. Bullish sentiment has been off the charts and we were overdue for a correction.

I see this as nothing more than profit-taking. The earnings news was decent. Of the 35 companies that reported after yesterday's close, only six have missed estimates. That means 85% hit estimates or exceeded them. Most companies that have reported earnings this week have traded lower after the announcement.

Tech stocks are getting hit particularly hard. There are concerns that semiconductor inventory is building and we saw that again when Xilinx posted its numbers. F5 Networks had good results and the stock is down 25%. The guidance was not robust enough and traders are taking profits. This stock had doubled since July and fantastic news was priced in.

Banks had the potential to fuel this rally since they have lagged the market. Unfortunately, trading profits have been dismal. Financial institutions have been able to meet or beat expectations, but the quality of the earnings is poor. Banks are reducing bad loan reserves and investors are not very satisfied with that source of income.

Parker Hannifin is a cyclical stock and it beat estimates by 6%. The company benefited from a lower tax rate and when considering this adjustment, it actually missed estimates by three cents. The company said sales increased in each segment and it raised Q2 guidance. Even after this good news, the stock is down $4.00. That makes me wonder if cyclical stocks are topping out. This sector has been leading the market higher.

The economic news today was good. Initial jobless claims dropped to 404,000 from 441,000 the week before. Seasonal adjustments have run their course and employment conditions are gradually improving. Tomorrow's LEI and Philly Fed should have little impact on the market. The focus will continue to be earnings and next week's Durable Goods Orders and GDP should not have a major impact. The FOMC meeting is not likely to produce a move either since the Fed is steadfast in its quantitative easing.

Interest rates in Portugal, Spain and Italy are lower today. Credit concerns in Europe have eased temporarily and that is not weighing on the market.

Rising interest rates in Europe or a slowdown in China are the only two events that could cause a sustained market decline. Neither presents an immediate threat and this market pullback is nothing more than profit-taking. Prices should stabilize around SPY 126. If that level fails, we will test major support at SPY 123. I still feel that it is too early for a major meltdown and this pullback will eventually present a nice buying opportunity.

Credit concerns in Europe and state deficits in US will take months to manifest. I am patiently waiting for more stocks to announce earnings in the next few days. I am ready to sell put spreads on companies that beat earnings estimates and provide robust guidance. My short strike will be below support so that I have added protection.

Look for continued weakness today and a possible test of SPY 126 in the next few days. I sold my call positions yesterday when the market did not rebound and I made a little money. Now, I am left with my put credit spreads. Those positions expire tomorrow and they will yield a nice profit. Stay liquid and be nimble. Better opportunities will present themselves in the next week. I prefer to trade after earnings are released.

Daily Bulletin Continues...