This Is A Huge Week For Earnings. Stocks Should Push Higher.

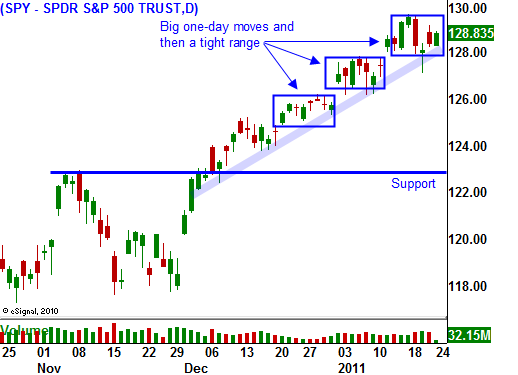

In the last few weeks, the market has developed a pattern where it stages a big one day rally and then it consolidates for a week or so. Trading has been very news driven and now we are waiting for the next event.

The economic news this week will feature durable goods orders, Q4 GDP and initial claims. All three numbers should be mildly bullish and I am not expecting a major reaction unless there is a substantial "miss". The FOMC will release its statement on Wednesday. Economic conditions have been improving and I believe their rhetoric will be more optimistic. Some traders might construe that as "hawkish" and it may signal the end to quantitative easing in a few months.

Earnings have been good and 85% of companies have hit or exceed estimates. After the close we will hear from American Express, CSX, Jacobs Engineering, Texas Instruments, VMWare and Zions Bancorp. Financials and technology have been weak after reporting results and these releases should have a slightly negative bias. Tomorrow morning, we will hear from major companies across every sector. This is a huge week for releases.

Credit concerns in Europe have temporarily subsided. That means the market will be able to push higher.

Stocks are creeping higher today and they are within striking distance of SPY 130. I am expecting another decent week for the market. The only stumbling block is the FOMC statement Wednesday afternoon.

After this week, I believe all of the good news will be priced into the market and the headwinds will start blowing. Traders will start looking ahead to the next round of PIIGS bond auctions and interest rates will continue to creep higher. I am not looking for a major market decline, just a normal pullback to keep bullish speculators honest. First support at SPY 126 will get tested and major support at SPY 123 will hold. The market is likely to bounce from there as long as credit conditions are stable and China's growth is in place.

Towards the end of the week I will be selling call credit spreads on stocks that decline after earnings. I am looking for candidates that have formed resistance and have not rallied with the market. I will need a small pullback before I start selling put credit spreads. The market feels like it will fall into a trading range. I will keep my positions small.

Daily Bulletin Continues...