Light Trading Is Setting In While the Market Searches For A Catalyst

The market is off to a very slow start. It has not moved much in the last two days and it might need time to consolidate. The news is light this week and next Monday is an exchange holiday. That means this quiet trading pattern could settle in.

The overseas news was generally good. Inflation in China and India was lower than expected. Both countries have been forced to raise interest rates in part because of higher prices.

This morning, President Obama provided insight on his budget. He said that he will consider making changes to entitlement programs. Republicans are pushing for this reform and they know this is a vital component to a balanced budget. All of the other "spending freezes" and cuts are miniscule compared to escalating entitlement expenses.

Retail sales came in a little light this morning. Analysts were expecting .5% increase and the number came in at .3%. Retailers will dominate the earnings scene this week and I'm expecting good results. This sector will not spark a huge market rally, but it should provide a positive backdrop.

The PPI and CPI will be released later in the week and they have not typically generated much of a market reaction. Traders have been able to focus on core inflation (minus food and energy) and that is not likely to change much. If food and energy prices stay elevated for a prolonged period of time, they will impact discretionary spending. We are not to that point yet.

I have been selling out of the money put credit spreads on stocks that have released good earnings and have provided strong guidance. My short strike is below technical support. Support levels attract buyers and that will provide added protection if the market declines.

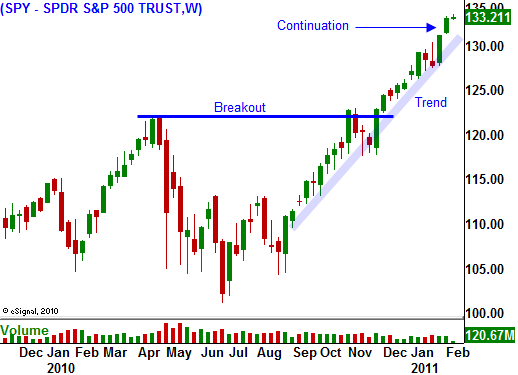

I will only buy calls if we get a pullback or if the market consolidates in a tight range (gathers strength) for a few weeks. Bullish sentiment is sky-high and we are overdue for a short, swift decline.

Option expiration could provide a small upside boost this week. Look for light trading this week with an upward bias.

Daily Bulletin Continues...