Earnings News Trumps Higher Core Inflation. Stocks Should Grind Higher Through Friday.

Stocks are taking a breather this week. Much of the good earnings news is already "baked into” the market and traders are looking for the next catalyst.

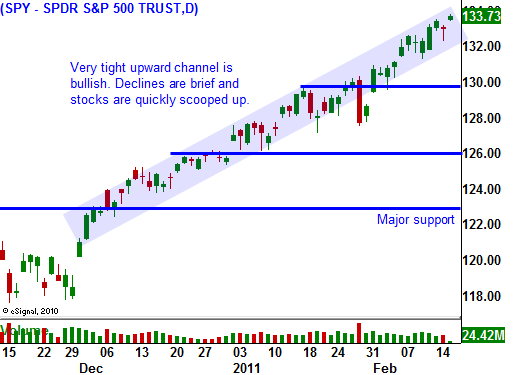

In the last six quarters, stocks have declined towards the end of earnings season. Typically, we would start to see that selling. Asset Managers are waiting for that pullback so that they can load up. Unfortunately, everyone has the same game plan and the buying is aggressive. On any tiny decline, stocks are scooped up. This leads me to believe that we won’t get that decline.

The market is overbought and bullish sentiment is off the charts. Under normal circumstances, this would result in a sharp, swift decline if valuations get stretched. Stocks are cheap and they have been suppressed by the threat of a credit crisis. That fear has subsided and money is flowing out of bonds and into equities.

I have also been waiting for a pullback, but I suspect that stocks will trade in a tight range before moving higher. This consolidation will give the market time to build strength.

The overnight news was good. Dell and John Deere posted excellent earnings. Family Dollar was taken over at a nice premium and that has the entire retail sector trading higher. As I mentioned yesterday, retailers will dominate earnings this week and I believe they provide a positive back drop.

This morning, core producer prices rose .5% and that was the largest increase in two years. Traders have been able to discount inflation readings because the core (minus food and energy) has been stable. Conditions are changing and this number will carry more and more weight in future months. Tomorrow, consumer prices will be released. To this point, producers have eaten higher costs and we will see if they are starting to pass some of that expense to consumers.

This afternoon, the FOMC minutes will be released. It will reveal the Fed’s perspective on inflation and that is the most interesting component. They will complete QE2 as they have already stated.

The market momentum is strong and stocks should grind higher. Option expiration buy programs could kick in and that will help. I am not looking for a massive rally, just a nice upward bias. The market is closed Monday and trading activity could be relatively quiet heading into the weekend.

I can stomach missing some of this rally, but I can't handle having the rug pulled out from under me. My better judgment tells me that a passive approach is prudent given the recent run-up. My put spreads are making nice money. After expiration, I might shift to buying calendar spreads. I would purchase April out of the money call options and sell March options with the same strike. If the market continues to stay quiet or grind a little higher, this strategy will pay off nicely. The position risk is also low. I will only do this if the market does not pull back.

Look for a small rally and a bullish bias the remainder of the week.

Daily Bulletin Continues...