Strong Economic News Trumps Threat of Higher Interest Rates. Expectations High For Friday’s Number

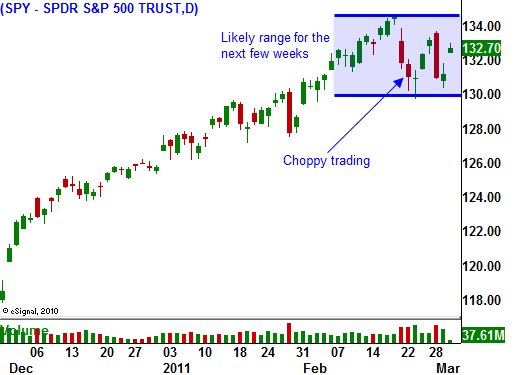

This has been a news filled week. The market has had to deal with many crosscurrents and it is swinging wildly within a trading range. Resistance at SPY 135 is firmly in place and interest rates/inflation will provide a stiff headwind. Asset Managers want to buy dips and support at SPY 130 is also strong. I expect this choppy price action to continue for a few weeks.

Concerns in Libya started the week off on a shaky note. Rebel forces are converging on Tripoli and a peace deal has been crafted by Hugo Chavez. Rebels are not likely to concede anything after coming this far. This news sparked selling in oil futures and the market is feeling some relief this morning. The oilfields are the primary concern and so far they have been spared. Saudi Arabia has increased production and if conditions in Libya and Oman stabilize, we could see lower fuel prices in a matter of weeks.

The ECB released its statement and Trichet says that an interest rate hike in April is possible. Inflation expectations have been raised and surprisingly, European markets traded higher after this hawkish rhetoric.

European credit concerns could start to surface in coming weeks. Greek citizens have initiated a movement called "I Don't Pay". They are not paying tolls or fares for public transportation. If this protest spreads to income taxes, the country could be in dire straits. Meanwhile, Portugal has to auction €4 billion in each of the next three months. Their interest rates have stayed above 7% and a bailout is likely. Spain's unemployment rose above 20% in the fourth quarter. They held an auction over night and the bid to cover was 2.2 (decent but not great) and yields rose 30 basis points from the prior month. Structural debt problems have not been addressed and until they are, the bailouts will be never-ending.

In the US, the economic news has been very strong. ISM services rose to 59.8, retailers exceeded February same-store sales estimates and initial jobless claims dropped to a 2 1/2 year low. Earlier in the week, ADP reported better-than-expected private sector job growth and ISM manufacturing rose to a seven-year high. Economic conditions are improving and the market is staging a huge rally.

Tomorrow, the Unemployment Report will be released. After all of the encouraging news this week, estimates are being increased. January's number could be revised upwards since heavy snowfall might have had a negative influence on jobs. February has also had its share of bad weather and if we miss the expected 185,000 new jobs, I believe the market will blame heavy snow in the upper Midwest and East Coast. The expectations for a good number are already built in after today's rally. I am expecting a good number, but not much upside action.

There are plenty of crosscurrents and choppy trading should continue for at least a few weeks. QE2 will soon be concluded and interest rates will move higher. As long as the rise is accompanied by economic growth, the market will be able to move higher. If inflation becomes an issue, this rally will stall.

Unrest in the Middle East is not likely to spread and protests will settle down in coming weeks. That will result in lower oil prices and inflation concerns will ease. The market will rally as a result and the timing will coincide with buying ahead of earnings season. I am still bullish on a short-term basis and I believe this market has one good rally left in it.

Across all of my research reports we have been selling out of the money put credit spreads. A choppy market with a bullish bias sets up perfectly for this strategy. I am focusing on commodity stocks. I would be underweight energy since oil prices could decline. Agriculture, ore and coal have been my favorite areas for put credit spreads. I also like heavy equipment companies that sell to emerging markets.

The news is fairly light next week. Try to sell some premium while option implied volatilities are still elevated.

Daily Bulletin Continues...