The Market Will Breakout Next Week As Earnings Season Kicks Off.

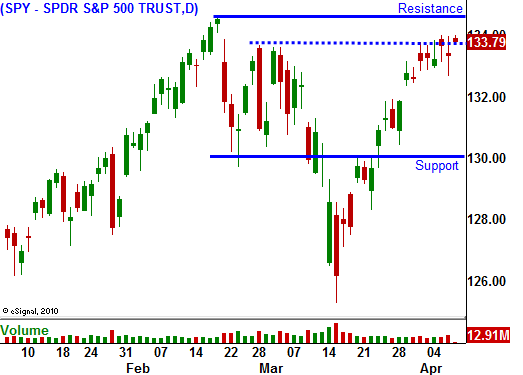

The price action this week has been very dull and the market is consolidating near the highs of the year. The SPY has traded in a 1 point range since March 30th and it is gathering strength. I believe we will see a breakout next week as earnings season kicks off.

The market was able to deflect a round of negative news this week and that affirms a strong bid. Portugal requested a bailout from the EU, the ECB and China raised interest rates, radiation leaks in Japan are worse than expected, and Congress can't reach a budget agreement. All of these news items would normally translate into selling pressure during a quiet news week.

Stocks held strong and that bodes well for next week. Alcoa will post its results Monday and then there will be a lull. Google releases earnings on Thursday and that is the only other major release next week. After that, the floodgates will open.

The economic releases next week will be highlighted by the PPI and CPI. Core inflation is likely to be stable and food/energy will rise. The Fed is only concerned with the core, but if food/energy prices stay elevated for a prolonged period of time, it will impact consumption.

The fighting in Libya has reached a stalemate. Qadaffi is targeting oil fields in the East so that rebels can't finance their cause. This will keep fuel prices elevated for a prolonged period of time. Nigeria is another African oil producer. They postponed elections and the delay could spark rioting. This will also keep upward pressure on oil prices.

I believe the market will make a new relative high and three weeks into earnings season, stocks will stall. Higher input prices will hurt profit margins and corporations will give cautious guidance. Supply disruptions from Japan's earthquake will also cloud the future. Stocks will be priced for good news and the release late in April won't pack much of a punch.

This timeline also coincides with other issues. The EU has not reached an agreement on bailout policies and that will weigh on credit markets as Portugal waits for aid. The economic decline created by Japan's earthquake will surface and investors wonder how long it might last. China's interest rate hikes will start to take effect and traders will wonder if they over-tightened or if the earthquake is to blame. QE2 will be ending and Congress will be battling over the 2012 budget. We will follow the old saying, "sell in May and go away".

The market has been very resilient and I don't believe we will see a massive market decline. It will simply be a strong round of profit taking that will result in a drift lower during the summer months. Option premiums are cheap and put buying during the initial stages will make sense.

For now, get ready for one last push higher. Buy calls on strong stocks that are breaking out on the Live Update table. Avoid holding positions over the actual earnings release. Ride this wave as long as the momentum lasts. In my daily comments I will reference support levels and I will tell you when it's time to take profits. We are on the brink of a nice bullish trading opportunity – be ready.

Daily Bulletin Continues...