Financials Will Be The Key To This Rally – Use JPM Earnings Reaction This Week As A Guide

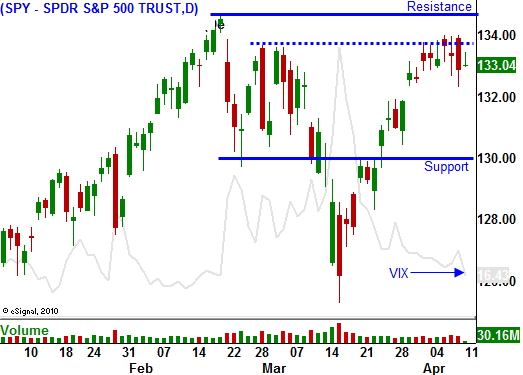

The market ran up to resistance and it stalled last week. There have not been many news releases to drive the price action and that will continue this week. Alcoa kicks off earnings season after the close today. Stocks tend to rally during the first few weeks of earnings and we are entering a bullish period.

The economic releases this week include PPI, CPI and the Beige Book. Food and energy prices are creeping higher and they will eventually bite into discretionary spending. The Fed strips these volatile components out of their models and because they only focus on the core rate, they are not concerned. We should not see too much of a reaction to the inflation numbers this week. The Beige Book will show generally improving conditions and it should be positive for the market.

The only other releases worth mention this week are J.P. Morgan and Google. Both are solid companies and I'm expecting good results. Financial stocks could be the catalyst for market breakout. Economic conditions have been improving and write-downs will decrease. After this week, the floodgates will open and we will get releases from every group and sector.

Congress passed the budget one hour before the deadline Friday evening. Spending will be cut by $39 billion from now until the fiscal year end in September. The real battle lines will be drawn as the 2012 budget talks begin. President Obama will address the nation Wednesday and some analysts believe he will even table cuts to Medicare. This speech will be nothing more than lip service.

The entitlement reform we need to balance the budget would cause rioting in the streets and not one politician has the stones to propose these changes. The fact that politicians are even talking about structural reform will be "market friendly", but nothing will change. The can will keep getting kicked down the road. Both parties could not even trim $40B from a $3.7 trillion budget without weeks of haggling and a last-second standoff.

Portugal needs financial aid and the list of bailout recipients grows. The EU still can't reach an agreement on bailout policies and the heat is getting turned up. Like Greece, Ireland and Portugal, Spain insists it won't need financial aid.

The earthquake in Japan will push it dangerously close to a financial crisis. Their debt levels are extreme and if interest rates rise just 1.25%, all of their tax revenues won't cover the interest expense on their national debt. They plan to make big budget cuts so that they can reallocate the money to reconstruction. Corporate taxes were going to get cut this year and that will be postponed.

Earnings season will push the market higher and stocks will break out. As the market reaches for new relative highs, bullish speculators will pile in. Cash flows into equity funds have been very strong and retail accounts are getting back into the market. Towards the end of April, all of the good news will be priced in. Corporations will provide cautious guidance because of inflation and because of supply disruptions in Japan. Stocks will roll over and they will fall back below SPY 135. That will flush out retail speculators and I'm expecting a swift decline in May.

Credit conditions in Europe, the end of QE2, tightening in China, high oil prices and the impact of the earthquake will all weigh in the market. I believe stocks will drift lower and June in July just as they did last year.

This is a time to get long and to trade this final push higher. Watch JPM this week. It will set the tone for the market. If the earnings reaction is good, the market will lift off and financials will lead the breakout next week. If the earnings reaction is lackluster, the magnitude of the rally will be limited. Tech stocks and financial stocks are the key to this last push.

Daily Bulletin Continues...