Strong Tech Earnings Fuel A Rebound Off Of Support. New Highs Are Within Striking Distance

Market conditions have changed dramatically overnight. Intel, IBM and VM Ware posted huge numbers after the close and tech stocks are flying. The S&P 500 is up more than 18 points pre-open.

The entire sector has been beaten down after a negative report from IDC last week and worries that earthquake related supply disruptions would hurt sales. As I mentioned yesterday, these fears were overblown and tech stocks had plenty of upside potential. Intel criticized IDC and said that they are missing large pockets of business in emerging markets. The guidance from all three companies was very positive.

Financial stocks aren't providing the "pop" I had hoped for, but the earnings have been decent. Analysts are concerned with the quality of profits and they don't like that the gains are coming from reductions in loan loss reserves. Financials won't lead, but they won’t weigh on the market either.

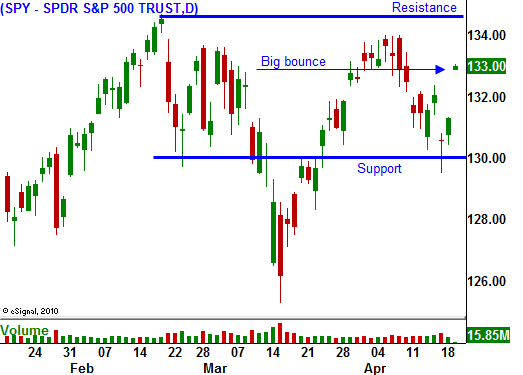

When Standard & Poor's downgraded the outlook for the US, it gave nervous investors a reason to sell. Support at SPY 130 held and that was a positive sign. Ratings agencies have no credibility and this news was already priced into the market. The “weak hands” were flushed out and now we should see some bona fide buying.

Credit concerns in Europe have also been an issue. The elections in Finland were not as "market negative" as they could've been. They will contribute to the bailout fund. Bond auctions in Spain went well overnight and China supported the offerings as indicated. The Greek "stress test" conducted by the EU won't be known until June. Analysts might suspect that debt restructuring is imminent, but they don't have concrete proof yet.

As I've been mentioning, there are cracks in the EU dam, but it will hold for now. If the EU can't agree on bailout policies in the next month or two, the heat will get turned up. In the process, there will be many heated debates and the market will pick up on the dissention.

Congress needs to raise the debt ceiling. Obama's speech last week drove a wedge between both parties when he attacked the Republican budget plan. Now the debt ceiling is being used as leverage. This is the wrong battle field and we still have a few weeks before the ceiling is reached. That means the market can focus on earnings. Like the 2011 budget, these issues are often resolved at the 12th hour and the market won't get too concerned about it until we are a week out.

Earnings that will be released after the close and before the open look "market friendly". The market should be able to build on its gains and I don't see any trouble spots. Today's rebound will bring out buyers. If the highs are established early and the market can't build momentum into the close, we will grind back to the highs of the year and resistance will be formidable. This is the most likely scenario because of the dark clouds on the horizon.

On the other hand, if stocks are able to follow through the rest of the week, we will break out to a new high for the year. Speculation and short covering could provide a nice surge in this scenario. I thought this might be possible a week ago, but financials are not providing the boost we need. Without leadership from this critical sector, profit taking should keep a lid on the rally.

You should still be hanging on to your long call positions. As I mentioned Monday, we weren't going to bail unless the SPY closed below 130. We weathered the "head fake" and today we should make nice money on our positions. This final rally could be rather tenuous and I suggest taking profits along the way. As we reach the highs of the year, reduce your longs by 75%. If we do breakout, you will have some skin in the game. If we reverse off of resistance, you will have a relatively small position to get out of.

If you have been buying the stocks that have been at the top of the Live Update table, you should do very well. I believe the market will open with a pop this morning, settle back after the initial surge and then grind higher in the afternoon. It should close somewhere around SPY 133.50. We have been positioning ourselves for this final push, enjoy it and take profits along the way.

Daily Bulletin Continues...