Another Round of Strong Tech Earnings Is Pushing Stocks Higher – Stay Long!

All OneOption services are 25% off through Sunday April 24th and the prices on the website already relflect the discount. CLICK HERE FOR MORE INFORMATION.

Yesterday, the market surged higher on fantastic earnings news. Intel and IBM beat estimates and provided robust guidance. Tech stocks have been leading the market rally and this morning we have another round of excellent results. Apple and F5 networks posted strong earnings. The market is up nicely, but the excitement is contained after a big rally Wednesday.

Financials have not participated in this move and that has me questioning the upside potential. Improving employment should have produced excellent results. The market is not satisfied with the quality of earnings since loan-loss reductions represent a large portion of the bottom line.

Cyclical stocks will post strong results, but after a huge six-month run, I'm not expecting an explosive move in these stocks. Monetary tightening in China will keep a lid on these stocks. GE posted a 77% gain in profits, but the stock is trading lower. The energy and infrastructure segment had a 7% decline in revenues.

Retail stocks have been strong, but the upside is limited. Healthcare stocks have also posted excellent earnings, but uncertainty will limit any rally. Republicans are pushing for Medicare reform and Democrats still want a national healthcare program.

Basic materials have performed well and they will continue to push higher. Unfortunately, strong profits are tied to higher commodity prices. That eventually translates into inflation and smaller profit margins for manufactures. Both are negative for the market. If China’s economy shows any weakness, these stocks will drop quickly.

I still believe that the market has upside, but I feel the gains from this point on will be hard fought. Stay long and take profits along the way.

The focus will remain on earnings next week. There are still many tech stocks (including Microsoft) that will report. Many healthcare companies will also release earnings and the price action should be positive. After next week, the focus will gradually shift back macro events and that will kill the momentum.

Next week, durable goods orders, initial claims, Q1 GDP and Chicago PMI will be released. Consensus estimates are 1.7% for Q1 GDP and it will be the most important economic release of the week. I believe we will hit or exceed expectations. The FOMC will also meet. The rhetoric should be positive. They will discuss the end of QE2, but they have no intentions of raising interest rates in the near future. This should put the market at ease.

As we get into May, employment could be a concern. For the second week in a row, initial jobless claims have jumped. Jobs are the key to a sustained economic recovery.

There are many other macro issues that will pressure stocks. Portugal needs a bail out and the EU needs to agree on the policies. The banter between strong and weak countries will create a rift. Newly elected officials in Finland will approve or reject funding for Portugal in the middle of May. Greece is undergoing a "stress test" and if the EU determines debt levels are unsustainable, it will have to restructure. Bond yields are jumping and a restructuring would result in huge losses for European banks. The results of the "stress test" will be revealed in June.

With each passing week, the US draws closer to hitting its debt ceiling. If politicians make this a battleground, it could wreak havoc on the market.

China continues to slam on the brakes and they have progressively tightened. Any decline in China's economy will impact the rest of the world.

Japan has dangerously high debt levels and they will come to market with new bond offerings to finance reconstruction. This will compete with other bond auctions and interest rates will continue to push higher.

I love the earnings news so far, but macro issues will dampen spirits. The market is likely to pull back this summer. If the issues above are resolved in a satisfactory manner, we could see a nice year-end rally.

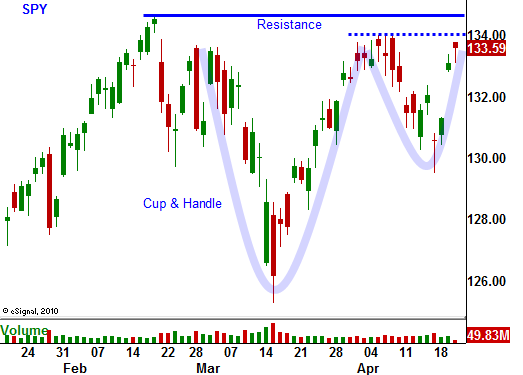

We will hang on to our long call positions over the weekend and into next week. By Thursday and Friday, I suggest scaling out of call positions. I will be evaluating the price action as we approach the highs of the year and I will tell you how aggressively to exit bullish positions.

If my forecast plays out, we could be selling call spreads during the first few weeks of May.

Daily Bulletin Continues...