Ride The Wave – This Is The Final Push Higher. Start Scaling Out Of Calls Late This Week

The market is moving higher this morning on strong earnings news. To this point, 30% of the S&P 500 has reported and 77% of companies have exceeded earnings estimates. The average "beat" is 5%. Over 70% of companies have exceeded revenue estimates. The market is inching closer to the highs of the year and as long as profits remain in focus, we will see a breakout to new highs for the year.

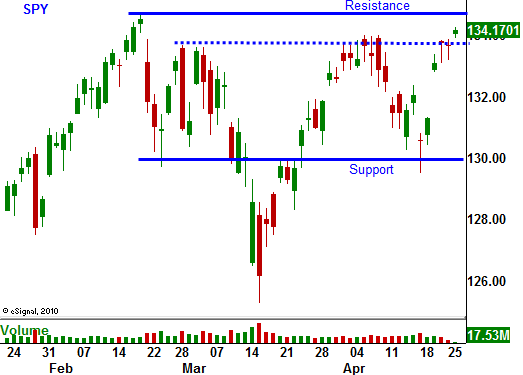

Health care and industrials are strong today. As I look at the earnings calendar during the next two days, I see many positives. We are at major resistance right now and I don’t believe we will breakout today. Traders need to assess a major piece of information tomorrow.

The FOMC will release a statement at 1:15 Eastern time tomorrow. Then, Chairman Bernanke will hold a special press conference to describe how the Fed will eventually tighten. Everyone knows this has to happen sooner or later and this speech will lay the groundwork. QE2 will end in a month, but the Fed has no intentions of raising rates. It still feels the economic recovery is fragile. The rhetoric should calm nerves in the short run and earnings will remain in focus.

The economic releases this week are also pretty light. This morning, consumer confidence was better than expected and home prices fell for the eighth straight month. There weren't any surprises and I'm not expecting GDP, durable goods or initial claims to spoil this rally. The economic releases next week will be huge and employment figures will impact the market.

I still feel that we have at least four or five more solid trading days before nagging issues weigh on the market. Initial jobless claims have been increasing and that might cause nervousness ahead of next week's employment numbers. Republicans and Democrats are jousting ahead of 2012 budget talks and this could delay a decision on the debt ceiling. This anxiety will build every day this goes unresolved and May 16th we run out of money. Greece is another "fly in the ointment". They will need to restructure and the EU plans a special meeting in the middle of May to discuss this. Unrest around the world (Libya, Syria, Yemen, Afghanistan, Thailand and Nigeria) is also concerning.

After the first few weeks of earnings season, all of the good news gets priced in and stocks become fully valued. Typically, the market stalls and rolls over towards the end of earnings season. This timetable coincides with the negative events mentioned above.

I believe the market will break out and we will see a round of short covering in the next few days. Bullish speculators will fuel the rally when they jump in. This spurt will quickly lose its momentum. In the next two weeks, we could see a swift round of selling. Investors will take profits and bullish speculators will take losses as they bail out of positions. Failed breakouts tend to produce swift declines. This reversal could set a negative tone for the summer.

Ride your call positions and use trailing stops. By the end of the week, have price targets in mind and start scaling out of positions. We want to be selling into strength once we get the breakout. When the upward momentum stalls, I will be selling out of the money call credit spreads and I will use the proceeds to buy out of the money June puts. I am not overly bearish, but I do see trouble ahead. If the market simply stands still, my call spreads will expire and I will own some free puts heading into June. That is my game plan for the next few weeks.

Enjoy the rally. We are positioned for it and we are making great money. Be ready to take profits.

Daily Bulletin Continues...