Bears Neutralized – Look For Choppy Trading Today – Chance For A Small Rally

Yesterday, bears squandered a perfect opportunity to knock the market down. A softer than expected industrial production number and weak guidance from Hewlett-Packard provided early selling pressure. The prior two sessions, the market had opened on its high and it closed on its low. This bearish pattern was ready to develop, but stocks strengthened throughout the day.

Corporate earnings were up 25% year-over-year in Q1. The S&P 500 is trading at a forward P/E of 13 and interest rates are at historic lows. The two-year uptrend has been particularly strong in the last eight months and stocks have rallied 35% since September. Stocks are cheap and this is not the type of environment where you should expect a dramatic decline.

Yes, there are dark storm clouds on the horizon, but none of them pose immediate danger. As we know from two years ago, the greatest market threat is a financial crisis. Japan, Europe and the US are deeply indebted and in a few years healthcare and Social Security will push us over the edge. The EU has been able to bail out smaller members and as long as China continues to support Spain's bond auctions, credit concerns will be minimal. This week, Spain held successful auctions and yields declined.

China presents a more immediate threat. The world is counting on them to pull us out of this recession and any economic contraction will impact global markets. They have been slamming on the brakes and tightening measures have been fast and furious this year. They are committed to heading off inflation and they will succeed.

The danger is that over-tightening will reveal an investment bubble. China subsidizes businesses and many would not exist without this support. We are likely to see excess capacity when the economy contracts. For instance, if current construction projects are completed, the country will have 30,000,000,000 ft.² of commercial office space. That is enough for a 5 x 5 cubicle for every man, woman and child in China.

Last week, China's imports declined more than expected. Analysts attributed that to the earthquake in Japan, but it could also signal that manufactures are cutting back on raw material purchases. Yesterday, Hewlett-Packard announced that Japan's earthquake will dramatically impact earnings in the second half of the year. China is also experiencing power shortages and electricity will be rationed. A drought has also reduced hydroelectric power. These events could severely limit output and even without tightening, their economic activity would've declined.

Conditions in the US are starting to soften and we need strong demand from emerging markets to keep our economy moving forward. Last week, ISM manufacturing and ISM services declined. ADP employment missed expectations and initial jobless claims have been climbing in the last month. Retail sales barely kept pace with inflation. Our economy feels like it's moving forward, but it is on artificial life support. The Fed continues its easy money policy and the dollar is getting crushed. Economic conditions in the US are stronger than they are in Europe and Japan. China is manning the respirator and they have their hand on the plug.

I laugh when I hear analysts say that the debt ceiling standoff could result in constructive 2012 budget cuts. Democrats are not going to cave in - there is no leverage. If Republicans cause the next credit crisis, they can kiss 2012 elections good-bye. This is similar to the child who threatens to stop breathing if they don't get their way. Republicans will watch the market fall apart and they will raise the debt ceiling. This maneuver won't accomplish anything, but it will create uncertainty. The longer this drags out, the greater the probability of a swift decline.

This afternoon, the FOMC's minutes will be released. Analysts will be picking apart the details on the Fed's QE2 exit strategy. Many believe that officials are more hawkish than Ben Bernanke and that sentiment will be revealed in the release. If this is true, we could see afternoon selling. Even if this is true, the Fed can adjust its comments to reflect the soft economic releases in the last week and I don't believe this will result in a big sell-off.

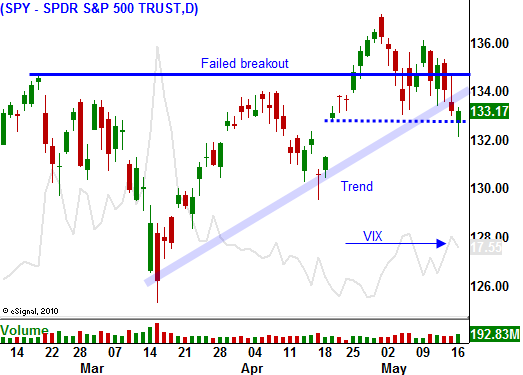

Earnings season is almost over and stocks are typically weak during this part of the cycle. QE2 is ending and bailout talks in Europe continue. These negatives along with the debt ceiling will keep a lid on stocks. Asset Managers won't chase stocks in this environment. Rallies will be contained, but this does not mean we will see a big decline. The market is resilient and valuations will attract buyers. I am holding on to my puts and I will do so as long as the SPY is below 135.

If we get into next week without much movement, things could really slow down ahead of the Memorial Day holiday. When we come back, we will get a heavy dose of economic releases. China's PMI will be the key release (June 1st). An economic slowdown in China is the only real market threat this summer. I believe the likelihood is high and we will have time to prepare. I am also expecting a downward revision to April’s Unemployment Report and that will be bearish.

The market rebound yesterday neutralized the bears and neither side has an advantage. Look for choppy trading today with a chance for a small rally.

Daily Bulletin Continues...