Fed Speak Should Be Friendly – Weakness On ECB Statement and China’s Trade Balance

Last week, we got a heavy dose of economic releases. China's PMI, ADP employment, ISM manufacturing, Challenger Gray & Christmas, initial claims and the Unemployment Report all pointed to economic contraction. GDP, Chicago PMI and durable goods orders set the tone the week before and investors took cover.

The news is fairly light this week and that should favor the bulls. Corporate earnings increased 25% year-over-year and the S&P 500 is trading at a forward P/E of 13. Without question, stocks are cheap. The two-year uptrend will attract buyers and Asset Managers are likely to view this 4% pullback as a buying opportunity. In light volume, they should be able to bid the market higher.

This is the first round of soft economic data and long-term bulls are likely to dismiss the news. They will point to temporary conditions and they will expect loose monetary policy. This afternoon, the Fed Chairman will speak. We are likely to hear that interest rates will remain stable. The rhetoric should be "dovish" after last week's employment figures and the market should stage a nice rebound this afternoon.

China did not raise rates over the holiday weekend as many expected. That is a positive sign and it also should provide a boost for the market next two days. However, I am expecting further tightening and this reprieve will be short-lived. China is trying to fend off inflation and the aggressive steps taken so far this year have not turned the tide. We can expect further action in coming weeks.

Thursday, the ECB will release its statement on monetary policy. Most analysts believe the rhetoric will be "hawkish" and it will point to a rate hike in July. Any softening in the statement would be bullish. After the close Thursday, China will post its trade balance. Last month, imports fell dramatically. That decline was attributed to the earthquake in Japan, but I suspect power outages across the country reduced the demand for raw materials. This will be a critical news item and if my suspicions are correct, we could see weakness Friday morning.

Domestically, the Beige Book will be released tomorrow. I am not expecting any major market reaction. Initial jobless claims will be released Thursday and it has the potential to disappoint. People that have lost their jobs tend to postpone their unemployment applications during major holidays and we could see the number pop this week. This could have a slightly negative impact when combined with the ECB's statement.

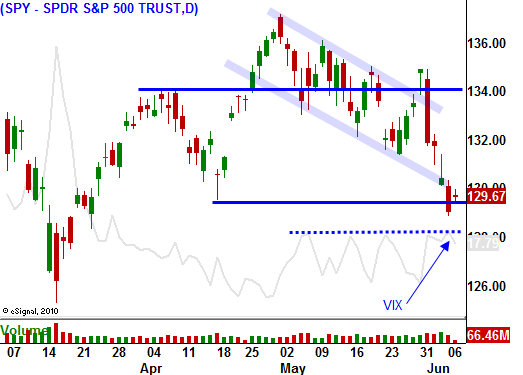

Looking back over the last two years, the market has had a number of swift declines. The first wave of selling is always the most dramatic because it flushes bullish speculators out of the market. Option implied volatilities were very low after Memorial Day and we were due for a correction.

It is almost impossible to forecast every wiggle and jiggle, but I believe prices will stabilize the next few days and inch higher. The SPY should be able to close back above 130. Thursday and Friday the news should be "a little heavy" and we could retest yesterday's low. The market will once again find support and the next bounce should be a little stronger.

Asset Managers are not going to bail on portfolios given current stock valuations and historically low bond yields. They will wait for further evidence of an economic decline before they take chips off the table. That news is not likely to come for another three weeks.

Here is the ideal setup. China postpones tightening, the ECB softens its rhetoric, the Fed maintains loose monetary policy and Greece/Portugal secure the funding they need. The market rebounds in June and it pushes towards SPY 135. Option implied volatilities decline in quiet trading and the table is set for the next leg down.

As we get towards July, I believe signs of an economic slowdown in China will surface. Republicans will hold the debt ceiling hostage and default worries will grow as August approaches. This would give us an excellent put buying opportunity. I am favoring the downside and my bearish bets will be bigger than my bullish bets this summer.

The market started off on a positive note this morning. Throughout the day, the strength is deteriorating. Bears will test the downside this afternoon. If they can't get anything going, it will be a sign that a bounce the next two days is likely. I am selling a few out of the money put credit spreads on stocks I like. This will keep me a safe distance from the action and it will allow me to weather any selling towards the end of the week. I still feel that we will see a bounce in the S&P 500, but I will not be playing it aggressively. The second bounce (next week) will be stronger than the one we see in the next couple of days.

Daily Bulletin Continues...