An Intraday Reversal After Heavy Selling Will Be A Sign of Support. Sell Put Spreads

Yesterday, stocks shrugged off a weaker than expected initial jobless claims number and hawkish rhetoric from the ECB. These events were expected and the market rallied early in the day. Stocks pulled back near the close, but they were able to hold most of the gains. Overnight, there were minor economic releases and statements from the Fed that spooked investors.

The biggest news in my opinion came from China. I thought imports might decline dramatically and they did not. However, exports to Europe and the United States did decline. Analysts surmised that growth in China is intact, but conditions are weakening in the West. While the news might seem bearish, exports did increase 19%. It's important to keep the news in perspective.

Germany agreed to extend financing to Greece and that is positive. Conditions in Europe will continue to deteriorate in coming months, but I do not sense immediate danger. Spain's bond yields have been stable and China has been supporting their auctions. As long as Spain can stay under the radar, credit crisis worries should be contained.

There will be many minor economic releases next week and they should show a slight decline in activity. Much of the bad news is already priced in and I believe support at SPY 125 will hold.

Nothing gets Washington's attention faster than a declining stock market. Now Republicans are considering a temporary solution to the debt ceiling. If this happens, it would be positive for the market. Both parties are discussing an extension of payroll tax credits. That would also be bullish for the market.

Economic growth is slowing, but there is growth nonetheless. QE2 is ending, but the Fed’s monetary policy is still very loose.

Stock valuations are attractive and bond yields are near historic lows. This is very bullish for the market. Given all of the information, I can't imagine a major market meltdown at this early stage.

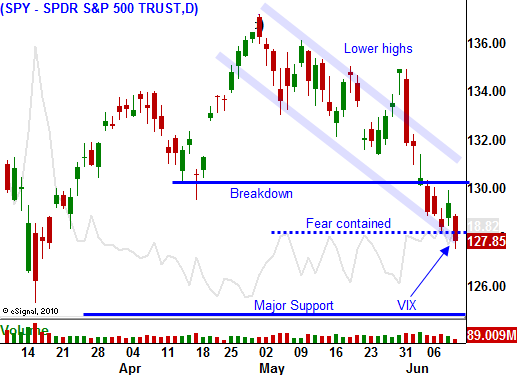

Bears will probe for support and Asset Managers will patiently wait for signs of a bottom. Once we reach that level, the market will rebound. There might still be some work to do on the downside, but I feel we are getting close to support.

I am selling put credit spreads today and I am building positions. As long as the SPY is above 125, I am comfortable with this strategy. Look for stocks that have major support and that have held up well during this recent market decline. After a nice rebound, the market will chop back and forth as it gathers more information. I want to take advantage of elevated option premiums and this strategy will allow me to keep my distance.

Support at SPY 128 has been breached today and we could drift lower ahead of the weekend. I will be looking for an intraday reversal where strong buying erases a hefty day of losses. That price action will tell me that short-term support has been established. Keep your size small and sell some put spreads to take advantage of attractive stock prices and time decay.

Daily Bulletin Continues...