Bears Are Confident. Wait For Signs Of Support.

Yesterday, the market started off on a positive note after initial jobless claims and housing data came in better than expected. Late in the day, bears were able to push stocks lower. That move did not gain traction and the market was able to rebound.

This morning, there are rumors that Germany and France will reach a compromise on how to restructure Greek debt. The market does not like uncertainty and stocks sold off two days ago when this looked like it might be unresolved for weeks. The market is staging a relief rally on the news.

Credit problems run throughout Europe and the EU knows it can't let Greece default. That would send a shockwave through an already fragile banking system. Weak peripheral countries would see their interest rates spike, pushing them to the brink of failure. Greece will get its funding in a few weeks and the EU will kick the can down the road.

The credit situation in Europe will weigh on the market this summer. China's steadfast tightening will lead to an economic slowdown and that will also create selling pressure.

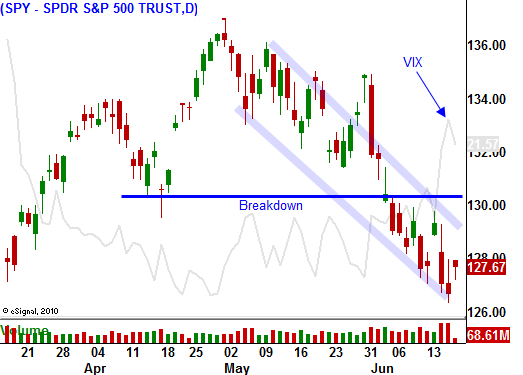

The price action has been very weak and bears are still probing for support. Rallies are shallow and traders are anxious to sell into them.

I have been looking for a bounce, and I don't know if we'll get one. Fear is always difficult to gauge and rioting in Greece is scaring the heck out of people.

The economic news next week is fairly light with GDP and durable goods orders. Typically, the market does not stage big moves on these releases. The FOMC will meet and I am expecting dovish statements.

I am hanging on to my put credit spreads, but I am not adding to positions. As long as the SPY is above 125, I will stay the course.

The momentum points lower and it will take a government driven news event (debt ceiling raised, payroll taxes extended, Greek restructuring agreement) to reverse that. Until bears see buying with strong follow through the next day, they will keep shorting rallies.

Look for strong stocks that have held up well during the recent market decline and have defined support levels. These will be your best put credit spreading stocks when the market firms up. Option premiums are elevated and this is a good time to use this strategy.

Be patient and wait for support.

Daily Bulletin Continues...