This Market Bounce Should Last Through The Week

Yesterday, the market was able to hold early gains and support at the 200-day moving average. This morning, the market is rallying on rumors that the confidence vote in Greece scheduled this evening will pass. It will be followed by a vote on the new austerity/privatization measures in Parliament next week. Analysts and insiders say that the Prime Minister is likely to succeed in passing the austerity package, having secured support within the party.

The EU will not let Greece fail. They will pressure them into making tough decisions but they won't let them default. There is too much at risk. The problems in Ireland, Portugal, Spain and Italy will grow, but a credit crisis will not unfold this summer.

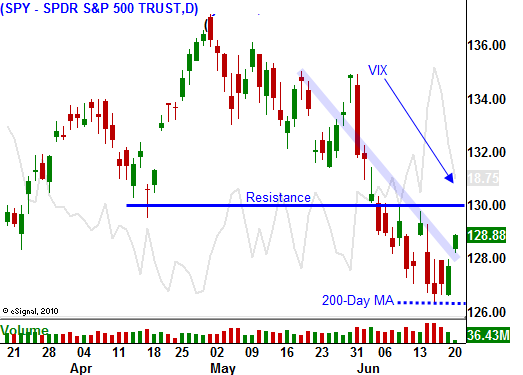

Today, stocks are moving higher and we are getting the bounce I've been looking for. Option implied volatilities are collapsing and you can see that in today's chart. Bad news is already factored in and any shred of good news was going to force shorts to cover.

Inflation readings in Hong Kong were higher-than-expected. This makes a rate hike in China more likely and I believe we will see it before the end of the month. Eventually, these tightening measures will result in economic contraction. A slowdown in China is the greatest market threat I see this summer.

GDP and durable goods orders will not have a major impact on the market this week. The FOMC will release a "market friendly" statement tomorrow given the recent decline in economic activity. All told, these releases should be positive.

Perhaps the biggest release of the week will be FedEx before the open on Wednesday. We've had an earnings lull and the company is an economic barometer. The guidance will be critical and I believe the company will make cautious statements. This will weigh on the market, but bad news is expected so the damage should be contained.

I have been selling out of the money put credit spreads. This strategy is working out well and today I am benefiting from a collapse in implied volatilities. Find strong stocks that have weathered the storm and have strong support levels. Sell put spreads below technical support and take advantage of this quiet period.

The market should be able to find buyers all the way into earnings season. By the end of July, conditions should deteriorate and we will be ready for the next leg down.

The market should be able to grind higher today. This bounce could take us back to SPY 132.

Daily Bulletin Continues...