Options Trading Strategy: Major Support Held. Sell Out of the Money Put Spreads on Tech Stocks

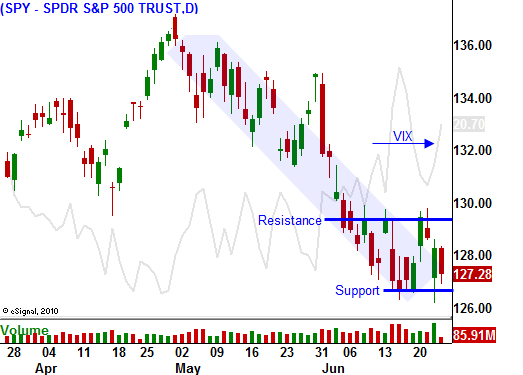

Yesterday, the market looked like it would test major support at SPY 125. The selling pressure was heavy and the market briefly poked below the 200-day moving average. By mid-afternoon, prices stabilized on news that Greece had reached a five-year austerity agreement with the ECB/IMF. That reversal gained traction and the market erased all of the losses.

The lows from June are holding and it feels like buyers are nibbling. We won't see any aggressive buying until Greece secures its financing next week. The country still has to approve the austerity plan and the vote on June 29th will be close. Unions are already planning a strike that day.

Just when the situation in Greece is getting resolved, issues in Italy surface. Moody's downgraded Italian banks and trading was halted after the shares tanked. UBI (Italy's fourth-largest bank) might have a difficult time placing its €1 billion rights offering. Interest rates spiked to a new high for the year and this is not a good sign. The EU has many "cracks in the dam" and next year they will not have enough fingers to plug the holes.

China's Premier Wen declared a victory over inflation. "We are confident prices will be firmly under control this year." Asian stocks rallied on the news and fears of a rate hike are subsiding. Personally, I believe China will continue to tighten.

Two Senators involved in the budget ceiling talks walked out of negotiations. This is a major setback and it will put additional pressure on Biden and Obama to reach an agreement. The longer this issue lingers, the more it will weigh on the market. If Republicans temporarily extend the debt ceiling, the market will rally.

A Wall Street Journal article reveals that many firms are incorporating overseas to avoid high domestic taxes. Illinois is a classic example. The state is deeply in debt and they raised corporate taxes 65% this year. Now many companies (CAT, SHLD, and BA) are threatening to leave and Illinois is reconsidering the tax hike. Corporations are like water, they will follow the path of least resistance. They provide jobs and they should not be considered as a captive source of tax revenue. In the US, corporations account for less than 15% of our total tax revenue.

Yesterday, Oracle posted great revenues and profits. Both exceeded expectations and the guidance was raised. The stock is pulling back slightly this morning. Earlier in the week, FedEx also posted great earnings and it raised guidance. This is the type of positive news that could spark a market bounce. In a matter of weeks, earnings season will begin. I don't believe the market will break down as earnings season approaches.

This morning, GDP and durable goods came in slightly better than expected. Next week, we will get personal income, initial claims, Chicago PMI, consumer sentiment, ISM manufacturing and construction spending. The numbers should be soft, but bad news is already priced in.

The major news event to watch next week is the vote in Greece. I believe it will pass and the market will be able to hold this support level. I will also be keeping an eye on Italian interest rates. If they stabilize, credit crisis fears will temporarily subside.

I still feel comfortable selling out of the money put credit spreads. Tech stocks have been beaten down and I see attractive valuations. The strong reversal in the QQQ yesterday tells me that buyers are lining up. Be selective and choose stocks that are above major support levels. Also, make sure long-term trend lines are intact.

Trading next week should be relatively quiet next and the news will be light. The market usually has a bullish bias heading into major holidays.

Daily Bulletin Continues...