Options Trading: The Market Believes the Votes In Greece Will Pass. Bulls Are Ingnoring the Riots

Yesterday, the market staged a nice rally and it continues to push higher this morning. Protests have turned violent in Greece ahead of austerity voting by the parliament. Surprisingly, the market has been able to shoulder the news.

There will be two votes this week. Tomorrow, the parliament will vote to approve the structure for austerity/privatization. On Thursday, they will actually vote on the plan itself. Most analysts believe tomorrow's vote will pass by a comfortable margin. However, the vote on Thursday could pass by as little as one or two votes. The market does not seem rattled by this slim margin.

French banks have already agreed to rollover Greek debt when it matures over the next few years. They will reinvest 70% of it and pull 30% out. Germany is considering doing the same, but banks want guarantees from the German government. The risk exposure for German banks is thought to be in the range of €10-€20 billion. We are not talking about large sums of money and consequently, this stage of the credit crisis should "blow over".

Spain and Italy pose a much bigger problem. The threat is small this year since China is supporting their bond auctions. Premier Wen is making his rounds in Europe and China is fully supporting austerity plans.

This morning, Meredith Whitney reiterated her stance on US municipal bond defaults. She said that state balance sheets are deteriorating and we will see major defaults in coming months."What you'll see now is as the states are submitting final budgets; you'll see the real pain at the municipal level start happening July 1. That will intensify and that's where you'll see the fallout."

This Friday, China will release its PMI. The flash reading last week was "light" and the market is prepared for a bad number. Premier Wen declared a victory over inflation last week and many analysts believe that China will stop tightening. If Friday's PMI comes in soft, this notion will gain traction and stocks should hold up.

This morning, Case-Shiller showed that home prices rose and the market rallied on the news. I believe this has more to do with strong seasonality than anything else. Thursday, Chicago PMI and initial jobless claims will be released. ISM manufacturing will be released on Friday. Manufacturing numbers have fallen dramatically in the last two months and I believe there is a chance for a small rebound.

As long as both votes in Greece pass, the market will rally. Stocks tend to move higher ahead of major holidays and the economic releases this week should not stand in the way. The market is oversold and we are due for a bounce.

Next week, employment statistics will be released. If jobs come in a little light or as expected, the market will rally. Earnings are the cure-all for this gloomy environment and Q2 reports will be released in two weeks. FedEx, Oracle and Nike (last night) posted great results and gave positive guidance. Earnings season will put a bid under this market and stocks will grind higher.

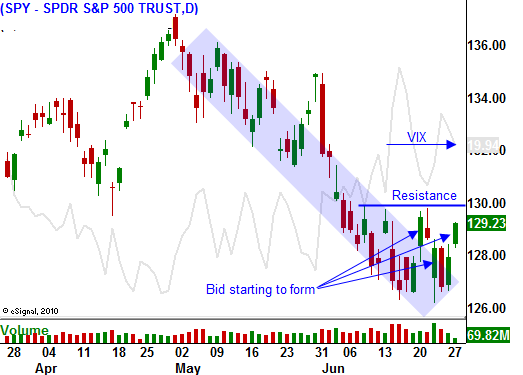

I like selling out of the money put credit spreads in this environment. Tech and energy have been beaten down and I see some attractive valuations in those sectors. Distance yourself from the action and sell puts below major support levels. If technical support is breached, buy back your spreads. As long as the market can hold SPY 125, this strategy will produce nice returns.

The market is expecting the votes in Greece to get passed - I am expecting the same. Since one or two votes will make the difference, I am not placing big bets. I am also distancing myself from the action so that I can adjust if the unexpected happens.

Daily Bulletin Continues...