Fear Of A Credit Crisis Is Spreading – Earnings Rally Could Be Brief

Yesterday, the market declined on European credit concerns. Once Greece secured its financing, traders started looking for the next weak link. Last week, Portugal's debt was downgraded to junk and Moody's downgraded Italian banks. That news caused Italy’s interest rates to spike to a new 2-year high.

As I have been mentioning the last couple of years, credit concerns will grow until we reach a breaking point. The market can deal with war, natural disasters and recessions, it can’t deal with a credit crisis.

We were not going to have a full blown meltdown until substantial economies (countries) are involved. Little old Greece caused a great deal of conflict within the EU and the “stakes have been raised”. Italy and Spain are too big to bail and too big to fail.

Spain’s interest rates have been stable because China has committed to purchasing their debt. The same is not true of Italy, a country that has carried a massive debt load for more than a decade.

In addition to the EU’s credit problems, US politicians are playing “chicken” with the debt ceiling and they don’t realize the danger. Many analysts are looking back to 1995 when Congress took 6 months to raise the debt ceiling. The market did not crash back then and that is giving them a false sense of security.

Fifteen years ago, our national debt was $3T, our unemployment rate was around 6% and we were on the brink of one of the best economic growth spurts our nation has ever seen. We were able to shoulder the uncertainty under those conditions.

This time around, our national debt is $15T, our unemployment rate is 9%, we barely avoided a financial crisis, there are global credit issues and our workers have aged to the point where they will start to draw benefits from our government. If the debt ceiling is not raised in the next two weeks, the market will tank. That is the only thing that will get Washington to reach a deal.

In addition to the credit concerns, China is slamming on the brakes and their economy is starting to slow down. It has been the engine for a global recovery and we won’t have that helping us. We also won’t have fiscal stimulus or QE2 working in our favor.

Yesterday, AA said revenues increased 27%. Profits were strong, but analysts fear that they might not hit next quarter’s targets because aluminum prices have declined. The stock was down $.20 after the news. Google and JP Morgan will release on Thursday and those are the next big releases.

Credit concerns can escalate at anytime and once they gain traction, fear can spiral out of control. Great earnings and cheap stock valuations might counter that nervousness for the next few weeks, but sellers will unload stocks into every rally if fear starts to grow.

I still believe that a meltdown is a year or more away. Actual defaults (not the threat of a default) will spark panic selling. Until then, governments will squirm like a worm on a hook trying to figure out ways to kick the can down the road. They will throw the “kitchen sink” at the problem and avoid a collapse.

If the EU forges bailout policies RIGHT NOW, they could keep this from escalating. Investors like the idea of a centralized credit facility, but they need to reach an agreement and they need to start holding auctions immediately.

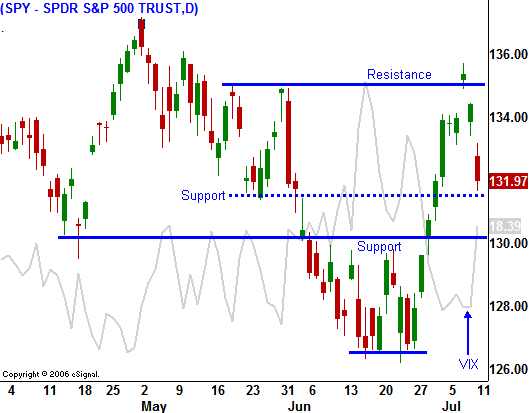

The earnings rally will be shallow if Italian rates continue to rise and if Washington can’t reach a debt ceiling agreement in the next two weeks. I will be getting out of the few call positions I have. I will also be watching how stocks react to solid earnings releases. If the stocks can’t get off of the deck after a good number, it will tell me that sellers are anxious to unload stocks and the rally will be brief.

If you don’t have any positions, stay on the sidelines. In the next few days I will have enough information to determine our next course of action.

Daily Bulletin Continues...