Jobs, Debt Celing and PIIGS Weigh On the Market. Earnings Rally May Be Shallow

The market is very unsettled after a weaker than expceted Unemployment Report last Friday. That news came after China and the ECB raised interest rates. Furthermore, Portugal's debt was downgraded to junk and Italian banks were downgraded. Today, Italian interest rates are jumping and that is not a good sign.

All of this news has cast a dark cloud over the market and we learned that debt celing talks over the weekend did not go well. Rumor has it that the discussions were heated and the $4T package is off the table. Now both parties are trying to see if they can find a temporary $2T solution.

Given the magnitude of the decline this morning, the earnings rally could be rather shallow. In fact, it might be nothing more than a bounce.

I have to see how the rest of the day plays out, but as of this moment, I plan to use that bounce as an opportunity to exit long positions. Your exposure should be rather limited since we were looking to buy calls on support after a jobs dip last week. We still have not seen that support and you should be on the sidelines.

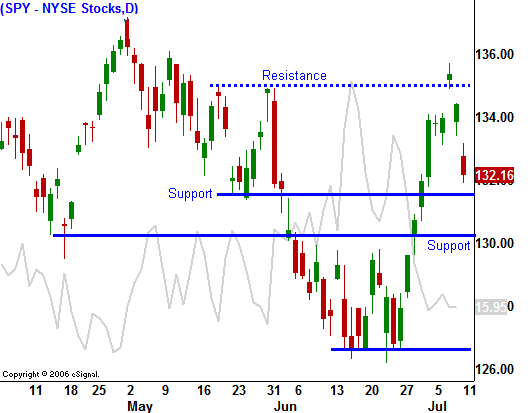

Support at SPY 132 is being tested. If it fails 130 will be tested in short order.

If you do not have long positions, hold off and wait for support. If you are long, hold on and try to exit on earnings strength this week. Revenues and profits should be strong and that positive news should spark buying.

Daily Bulletin Continues...