Good Earnings and Debt Ceiling Progress. Where’s the Follow-through?

Yesterday, the market started the day off on a positive note. Strong earnings from IBM pushed tech stocks higher and for a brief moment, traders forgot about the debt ceiling. The momentum had stalled two hours into trading and it appeared that resistance at SPY 132 would hold. News of a deficit reduction plan hit the market and stocks jumped mid-day.

The so-called "Gang of Six" reached a bipartisan agreement that would increase revenues and cut spending. It includes concessions from both sides and rumor has it that 60 Senators are backing it. Tax reform and entitlement cuts are included and our national debt could be reduced by $3.75 trillion over the next decade. This is the type of plan that Standard & Poor's and Moody's are looking for.

The proposal is four pages in length and it will take a long time to formalize it and to implement it. As long as it gets approved, both parties can temporarily vote to raise the debt ceiling. I am surprised in the turn of events.

Just a few weeks ago, Senator Coburn left the “group of six” and last week, President Obama stormed out of the discussions. These actions suggested an impasse.

We are likely to see a combination of the McConnell plan (allows the President to raise the debt ceiling) and the "Gang of Six" plan. This means that we might not see the sharp decline I was looking for.

It could take a long time to draft the legislation proposed by the "Gang of Six". If the debt ceiling is raised temporarily, Republicans fear that they might lose their leverage and Democrats will back out of the proposal. Consequently, Republicans could keep pushing for more cuts ahead of the deadline.

Yesterday, the House passed the "Cut, Cap and Balance" plan. It could reduce our national debt by $6 trillion over the next 10 years. Republicans control the House and this clearly shows their commitment to reducing budget deficits.

The "Cut, Cap and Balance" plan will get shot down in the Senate and if by some miracle it passes, it will be vetoed by the President.

Credit issues still loom in Europe and EU officials were supposed to be a two day meeting that started today. It has been shortened to one day. I mention this because their casual attitude. When interest rates in Spain and Italy started to skyrocket two weeks ago, they should've held an emergency meeting instead of going on vacation. The credit crisis grows and they still have not agreed to bail out policies. This means they can't ramp up their new credit facility. They should be holding auctions to raise bailout money right now and they are not.

The EU bank stress test was viewed as a joke by Wall Street. It was way too lenient and less than 10% failed. If EU officials don't make major progress tomorrow, PIIGS interest rates will rise along with credit fears.

The major economic event this week is China's flash PMI. It will be released tonight. We will see if six interest rate hikes this year and six increases in bank reserve requirements will finally have an impact. I suspect conditions will soften.

Earnings have been excellent and we should expect that since some of the strongest companies announce early in the cycle. The reaction has been muted today after Apple blew away estimates. After the close, Intel will release earnings and it will set the tone for beaten-down semiconductor stocks. I believe the number will be good and the reaction will be decent. Financial stocks have not been able to bounce and the market needs participation from this sector if it is going to rally.

As earnings season wears on, I believe the good news will be priced in and stocks will struggle even after posting solid results. Guidance will be cautious and that will keep a lid on optimism.

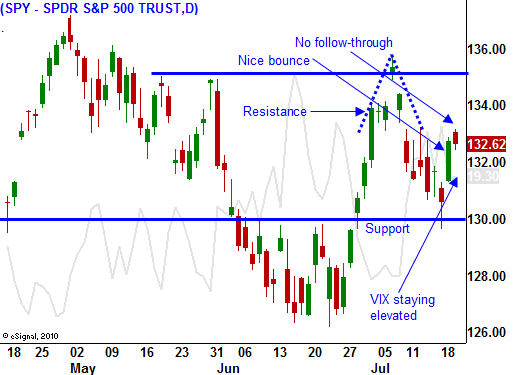

Now that debt ceiling fears have subsided, I thought we might get a nice follow-through rally today on the back of Apple's earnings. That has not happened and Asset Managers are still playing it safe. Many might be reducing risk and selling into strength. The VIX has pulled back a little, but it is still elevated and I believe investors are buying protection (puts).

The market could swing either way based on debt ceiling negotiations, EU bail out policies and economic growth in China. I am hanging on to a handful of puts and I am ready to bail if the market is able to rally late in the day. If does not, I will stick with my bearish positions.

Ideally, the SPY will close below support at 132, giving me renewed confidence. I have VERY little faith in Washington and I am trying to weather the curveball I was thrown yesterday. For the sake of the country, I hope I am wrong.

Daily Bulletin Continues...